Yes! You can use AI to fill out DHS-6696-ENG, Minnesota Health Care Programs Application (MNsure/DHS)

DHS-6696-ENG is Minnesota’s multi-page health coverage application used to collect household, tax filing, residency, citizenship/immigration, and income information needed to determine eligibility for public health programs and related financial assistance. It is important because the information you provide is used to verify identity and income, assess program eligibility (including MA and MinnesotaCare), and coordinate coverage with any existing insurance. The form also includes required consents and acknowledgments (privacy, rights/responsibilities, and tax information use) that affect verification and renewal of benefits.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out DHS-6696-ENG using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | DHS-6696-ENG, Minnesota Health Care Programs Application (MNsure/DHS) |

| Number of pages: | 13 |

| Language: | English |

| Categories: | immigration forms, insurance forms, CAR forms, Minnesota DHS forms, health care forms, MNsure forms, Minnesota government forms, L.A. Care forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out DHS-6696-ENG Online for Free in 2026

Are you looking to fill out a DHS-6696-ENG form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your DHS-6696-ENG form in just 37 seconds or less.

Follow these steps to fill out your DHS-6696-ENG form online using Instafill.ai:

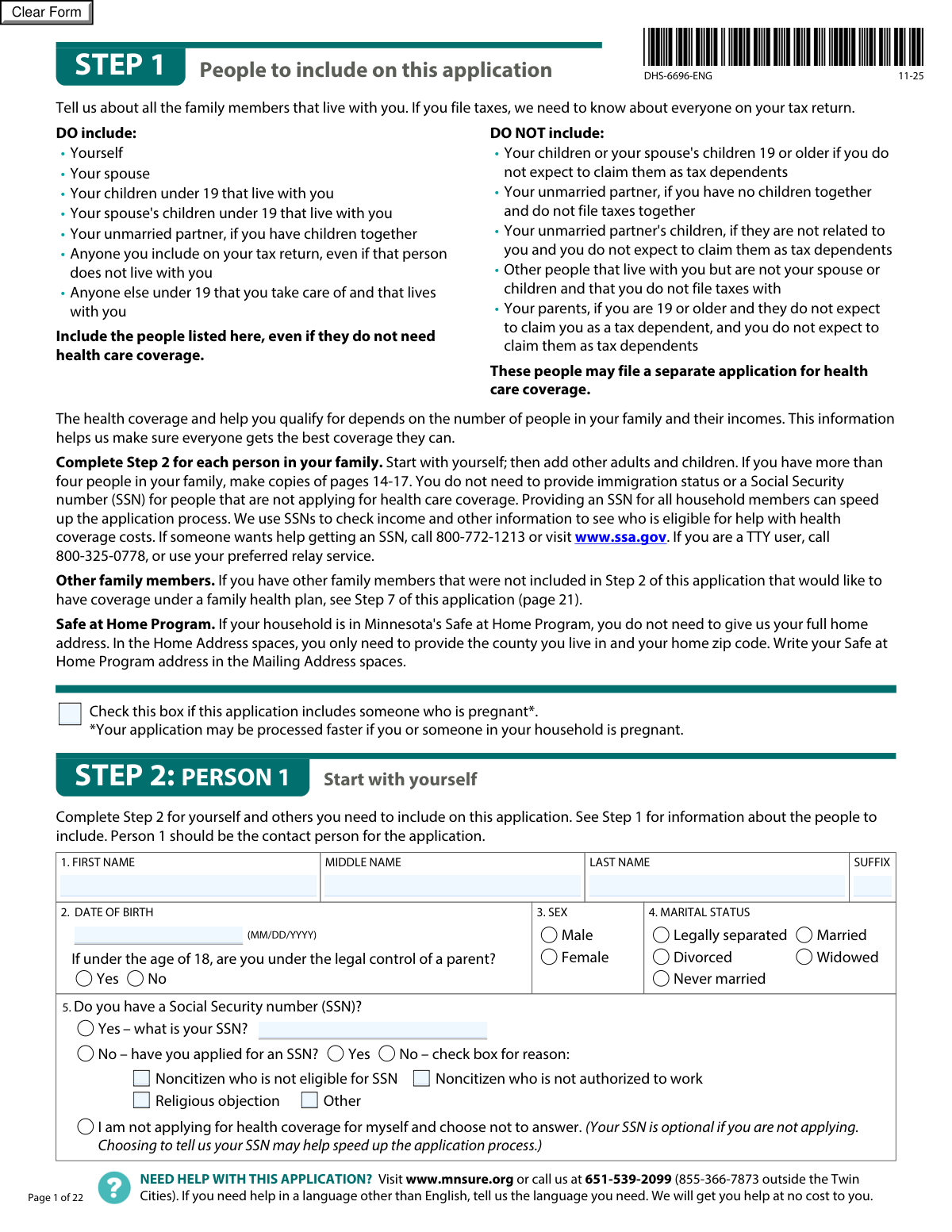

- 1 Review Step 1 rules to determine who must be included in the household (tax household and people living with you), and note whether anyone is pregnant or in the Safe at Home Program.

- 2 Complete Step 2 for Person 1 (the contact person): personal details, SSN/immigration (if applying), addresses, contact preferences, tax filing plans, pregnancy questions, and Minnesota residency questions.

- 3 Add each additional household member by completing Step 2 for Person 2, Person 3, etc. (make copies of the additional-person pages if needed), including whether each person is applying for coverage.

- 4 Enter job and income details for each person as applicable (employment, self-employment, seasonal income, other income, and adjustments), and provide projected annual income information when requested.

- 5 Complete Step 3 (current coverage, offers of employer coverage, accident/injury care) and any required appendices (e.g., Appendix A for job-based coverage offers, Appendix B for American Indian/Alaska Native status, Appendix C for an authorized representative).

- 6 Complete Step 4 and Step 5 household details and changes (military service, incarceration, foster care, disability/long-term care needs, temporary absence from Minnesota, and recent changes affecting eligibility).

- 7 Complete Step 6 consents and acknowledgments, sign and date the application, then submit the signed form and any appendices by fax, mail, or in person as instructed in Step 8.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable DHS-6696-ENG Form?

Speed

Complete your DHS-6696-ENG in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 DHS-6696-ENG form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form DHS-6696-ENG

This application is used to apply for Minnesota health care coverage and help paying for coverage costs, including programs like Medical Assistance (MA) and MinnesotaCare. It also helps determine eligibility for financial assistance based on household size and income.

Include everyone who lives with you and anyone on your tax return (even if they don’t live with you). You should also include your spouse and children under 19 who live with you, plus any dependents you claim.

Do not include adult children (19+) unless you expect to claim them as tax dependents, and do not include an unmarried partner unless you have children together or file taxes together. Roommates and other non-tax-related household members generally file their own application.

Yes, you may still need to list them if they are part of your household or tax family because household size and income affect eligibility. If someone is not applying, they do not have to provide an SSN or immigration status.

No—SSNs are optional for people who are not applying for coverage. However, providing SSNs (when available) can speed up processing because they are used to verify income and other eligibility information.

You can indicate that you do not have an SSN and select the reason (for example, noncitizen not eligible or not authorized to work). The form also asks whether you have applied for an SSN.

If you are in the Safe at Home Program, you do not need to provide your full home address—only your county and ZIP code in the Home Address section. Put your Safe at Home Program address in the Mailing Address section.

Check the box that says you are homeless and provide the county where you usually stay. You can still provide a mailing address if you have one where you can receive mail.

Answer whether you plan to file a federal tax return next year, whether you will file jointly, and whether you will claim dependents or be claimed as a dependent. If you claim dependents, you must list them on the application even if they are not applying for coverage.

Yes—check the pregnancy box and complete the pregnancy questions for the person who is pregnant, including due date and number of babies expected. The form notes that applications may be processed faster if someone in the household is pregnant.

No, these questions are optional and are not required to get health care coverage. They are used to help identify health disparities and improve care.

Yes, health care coverage may still be available even if you are not a U.S. citizen or do not have an immigration status listed. If you have an eligible immigration status, you can provide details like A-number/ID number, entry date, and document information.

This is for people who are not U.S. citizens/nationals and want help paying for a medical emergency. You’ll be asked to provide the begin and end dates of the emergency (if it has ended).

Yes—if you want Medical Assistance (MA) to help pay medical bills from the past three months, answer “Yes” and select which months you want help for. You’ll also be asked whether your household and income information was the same during those months.

For wages, you can choose a frequency (hourly, weekly, monthly, yearly, etc.), and if your hours/wages vary, the form instructs you to enter the total wages you expect for the next 12 months using the “Yearly” option. Be sure to list taxable wages and tips before taxes and exclude certain pre-tax deductions.

Do not list child support, nontaxable veteran’s payments, money from an ABLE account, or Supplemental Security Income (SSI). The form also clarifies that SSI is not a Social Security benefit.

Adjustments to income are certain expenses that can be subtracted from gross income on a federal tax return (like student loan interest or some self-employment deductions). Reporting them may lower the cost of your health coverage if you qualify.

In Step 3, you must answer whether anyone is offered health insurance from a job even if they are not enrolled (including coverage offered through a spouse or parent). If yes, you must complete Appendix A.

You can submit the signed application by fax (for faster processing), by mail using the enclosed envelope, or in person. Send it to your county or tribal agency or DHS Health Care Consumer Support using the addresses and fax numbers listed on Attachment B.

Compliance DHS-6696-ENG

Validation Checks by Instafill.ai

1

Person 1 identity fields completeness (name, DOB, sex, marital status)

Validates that Person 1 (the required contact person) has First Name, Last Name, Date of Birth, Sex, and Marital Status completed. These fields are foundational for eligibility determination, identity matching, and downstream notices. If any are missing or invalid, the submission should be flagged as incomplete and routed for correction before eligibility processing continues.

2

Date format and calendar validity for all date fields

Checks that every date provided (e.g., DOB, due date, pregnancy end date, move date, emergency begin/end, date of entry, temporary absence dates, military tour end date, signature date) is in MM/DD/YYYY format and represents a real calendar date. This prevents parsing errors and incorrect eligibility timelines. If validation fails, the system should reject the specific field(s) and request corrected dates.

3

Age-dependent legal control question consistency

Validates that the 'under legal control of a parent' question is answered only when the person is under 18 based on DOB, and is not answered (or is ignored) for adults. This ensures the form logic is followed and avoids contradictory household/guardianship assumptions. If an adult has this answered or a minor is missing it, the record should be flagged for review or the applicant prompted to correct.

4

Social Security Number (SSN) structure and conditional requirement logic

If SSN is provided, validates it is exactly 9 digits (allowing standard formatting like XXX-XX-XXXX) and not an obvious invalid value (e.g., all zeros). If the applicant indicates they have an SSN, the SSN field must be present; if they indicate no SSN, then either 'applied for SSN' must be answered or a valid reason must be selected when applicable. Failures should trigger a hard error when SSN is required by the applicant’s own selection, or a soft stop when optional but inconsistent.

5

Homeless indicator vs address requirements (including Safe at Home rules)

If 'homeless' is checked, validates that the county where the person usually stays is provided and that a full home street address is not required. If not homeless, validates that Home Address includes street, city, state, ZIP, and county, and that the home address is not a PO Box. If the Safe at Home Program is used, validates that home address contains at least county and ZIP and that the Safe at Home address is placed in Mailing Address; failures should prompt correction to prevent misdirected mail and privacy risks.

6

State and ZIP code validation for Minnesota residency fields

Validates that state values are valid US state abbreviations and that ZIP codes are 5 digits (or ZIP+4 if allowed), and cross-checks that Minnesota residency questions are consistent with a Minnesota address when coverage is requested. This reduces eligibility errors tied to residency and county-based administration. If the address is outside MN while the applicant claims MN residency, the submission should be flagged for manual review or additional proof.

7

Phone number format and contact preference dependency

Validates that phone numbers contain 10 digits (allowing common punctuation) and that at least one reachable phone is provided for the contact person. If the preferred method of contact is Email, an email address must be present; if text consent is 'Yes', a textable phone number must be provided. If validation fails, the system should block submission or require an alternate contact method to ensure the agency can communicate time-sensitive eligibility requests.

8

Language and interpreter request consistency

Checks that preferred spoken and written language fields are populated (or defaulted) and that if 'Need an interpreter' is marked Yes, a non-English spoken language is specified (or an explicit interpreter language is captured). This ensures accessibility compliance and prevents delays due to communication barriers. If inconsistent, the system should prompt for the missing language details before finalizing the application.

9

Tax filing intent and spouse/dependent sub-question logic

If the applicant plans to file a federal return, validates that joint filing question is answered and that spouse name is provided when filing jointly. If dependents are claimed, validates that dependent names are listed and that those individuals appear as household members in Step 2 (or are otherwise accounted for per instructions). If the applicant will be claimed as a dependent, validates that the tax filer name (and relationship for Person 2) is provided; failures should trigger a correction request because tax household composition drives eligibility.

10

Marital status vs tax filing selections consistency

Validates logical consistency between marital status and tax filing choices (e.g., selecting 'file jointly with a spouse' should not occur if marital status is 'Never married' unless a correction is made). Also checks that 'Married Filing Separately due to domestic abuse/spousal abandonment or Head of Household' is only asked/answered when relevant. If inconsistent, the system should flag for review because filing status affects premium tax credit and program eligibility.

11

Pregnancy details completeness and plausibility

If pregnancy is marked Yes, validates that number of babies expected is a positive integer and that a due date is provided and is not in the past. If 'pregnant in the past three months' is Yes, validates that the pregnancy end date is provided and falls within the last three months relative to the application/signature date. Failures should prompt correction because pregnancy status can change eligibility category and processing priority.

12

Minnesota residency question set completeness when applying for coverage

When a person is applying for health care coverage, validates that all four residency/intent questions (plan to make MN home, moved in last 3 months with date if yes, entered with job commitment, visiting for care/personal reasons) are answered. Also checks for contradictions (e.g., 'plan to make MN home = No' and 'visiting = No' while applying for coverage) that may indicate incorrect selections. If incomplete or contradictory, the system should require clarification before eligibility determination.

13

Citizenship/immigration section branching and document field validation

If U.S. citizen/national is Yes, ensures immigration status fields are not required and are left blank or ignored. If not a citizen/national and an immigration status is selected, validates that A-number/ID (if applicable), date of entry, document type/number, and expiration date (when required) are provided and correctly formatted; also enforces the additional LPR/parole/battered-noncitizen sub-questions (d–g) only for those statuses. If validation fails, the application should be flagged because immigration details can be required to determine program eligibility and coverage scope.

14

Medical emergency and MA retroactive coverage date logic

If emergency medical help is requested, validates that begin date is provided and end date (if provided) is on/after begin date and not in the future when the emergency is stated as ended. If MA help for past three months is requested, validates that at least one month checkbox is selected and that the 'everything the same' question is answered. Failures should trigger a correction request because retroactive coverage periods must be precisely defined for claims payment.

15

Employment selection vs required job/income fields

Validates that at least one employment status is selected (Employed, Self-employed, Seasonally employed, Not employed) and that the corresponding sections are completed. For employed jobs, employer name/address and wage amount plus frequency are required; for self-employment, type of work and either income or loss amount for next 12 months is required; for seasonal, seasonal income and expected unemployment benefits are required. If missing or mismatched, the system should block submission or route for follow-up because income is central to eligibility and financial assistance.

16

Income amount, frequency, and numeric constraints validation

Checks that all currency fields are numeric, non-negative where appropriate (allowing explicit loss amounts only in the self-employment loss field), and that exactly one frequency is selected per wage entry. Validates that average hours worked per week is numeric and within a reasonable range (e.g., 0–168) and that yearly projections are not entered with an hourly frequency. If validation fails, the system should request correction to prevent incorrect annualization and eligibility miscalculation.

Common Mistakes in Completing DHS-6696-ENG

Applicants often list everyone who lives in the home, but Step 1 is based on tax relationships and specific household rules (spouse, children under 19, tax dependents, etc.). This can inflate or shrink household size and lead to incorrect eligibility results, wrong program placement, or requests for clarification. To avoid this, follow the “DO include/DO NOT include” bullets exactly and cross-check against who will be on the next federal tax return (including dependents who don’t live with you).

A very common error is leaving off dependents when the applicant thinks “they already have insurance” or “they aren’t applying.” The form explicitly says dependents must be listed if claimed on the tax return, even if they are not applying for coverage. Missing dependents can change household size and financial assistance calculations, causing delays and incorrect determinations; list all dependents by name and ensure they appear somewhere in Step 2.

People frequently answer “No” to applying for coverage and then stop providing information that is still needed because the person is part of the household/tax unit. While SSN/immigration details may be optional for non-applicants, household composition and tax-filing information still affects eligibility for others. To avoid problems, decide separately: (1) who must be included in the household and (2) who is actually applying for coverage, and complete the required sections accordingly.

Applicants often check “Yes” for having an SSN but leave the SSN blank, transpose digits, or forget to answer whether they applied for an SSN and the reason if they have not. This can prevent electronic verification of income/identity and trigger manual follow-up requests. To avoid this, copy the SSN directly from the Social Security card (or official document), complete the “applied for SSN” question, and only choose the “not applying and choose not to answer” option if the person truly is not applying.

The form states not to put a PO Box in the Home Address field, but many applicants do because they receive mail there. This can cause residency/address verification issues and delays, especially if the county is missing or mismatched. Use a physical home address for Q7a, put the PO Box only in Mailing Address (Q12), and if enrolled in Safe at Home, provide only county and ZIP for the home address and put the Safe at Home address in the mailing section.

Applicants often provide a phone number but don’t mark whether it is cell/home/work, or they select email contact but forget to write the email address. Others indicate they need an interpreter but don’t clearly specify the preferred spoken language. This leads to missed notices, inability to reach the applicant, and processing delays; always label phone types, provide a valid email if selected, and complete language/interpreter fields consistently.

Tax questions are frequently misunderstood, especially “Will you be claimed as a dependent?” and the special Married Filing Separately exception for domestic abuse/spousal abandonment. Wrong answers can change eligibility for MinnesotaCare/MA and premium tax credits, and may create conflicts when data matches with IRS records. To avoid this, answer based on the upcoming tax year plan, confirm whether anyone else will claim you, and only mark the MFS abuse/abandonment option if it truly applies.

Many people enter take-home pay instead of “amount before taxes,” or they select a frequency that doesn’t match the amount (e.g., entering a biweekly amount but checking “monthly”). This can significantly distort annual income calculations and lead to incorrect eligibility or repayment risk later. Use gross pay from pay stubs, pick exactly one frequency that matches the number, and if income varies, use the “Yearly” option with a realistic 12-month estimate as instructed.

Applicants often leave employer name/address blank, write a supervisor’s name instead of the legal employer name, or enter the wrong identifier (using a phone number or state tax ID instead of the EIN). Missing or incorrect employer information can slow verification and create follow-up requests. To avoid this, use the employer name exactly as shown on the paycheck/W-2, include the full address if available, and copy the EIN from a W-2 or official payroll document (or leave it blank if unknown rather than guessing).

People commonly list child support or SSI under “Other income” because they assume all money received must be reported. The form explicitly says not to list child support, SSI, certain nontaxable veteran payments, and ABLE account money in this section, and including them can inflate income and reduce benefits incorrectly. Follow the note carefully, and when in doubt, only report items that would appear as taxable income on IRS Form 1040 (unless the form specifically asks for it).

Applicants often enter the amount deposited after Medicare premiums or other deductions, but the form requires the gross amount before deductions and includes both taxable and nontaxable Social Security benefits. Using the net amount can understate income and later cause eligibility corrections or overpayment issues. Use the SSA award letter or annual SSA-1099 to report the gross monthly benefit amount.

Applicants frequently answer current coverage questions incompletely (missing policyholder DOB, group number, covered members) or overlook the option to request help with medical bills from the past three months. Incomplete insurance details can delay coordination of benefits, and missing the past-three-month request can mean losing potential retroactive coverage. Carefully complete all policy fields and covered-person lists, and if you had recent medical bills, answer the MA past-three-month questions and select the correct months.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out DHS-6696-ENG with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills minnesota-application-for-health-coverage-and-help-paying-costs forms, ensuring each field is accurate.