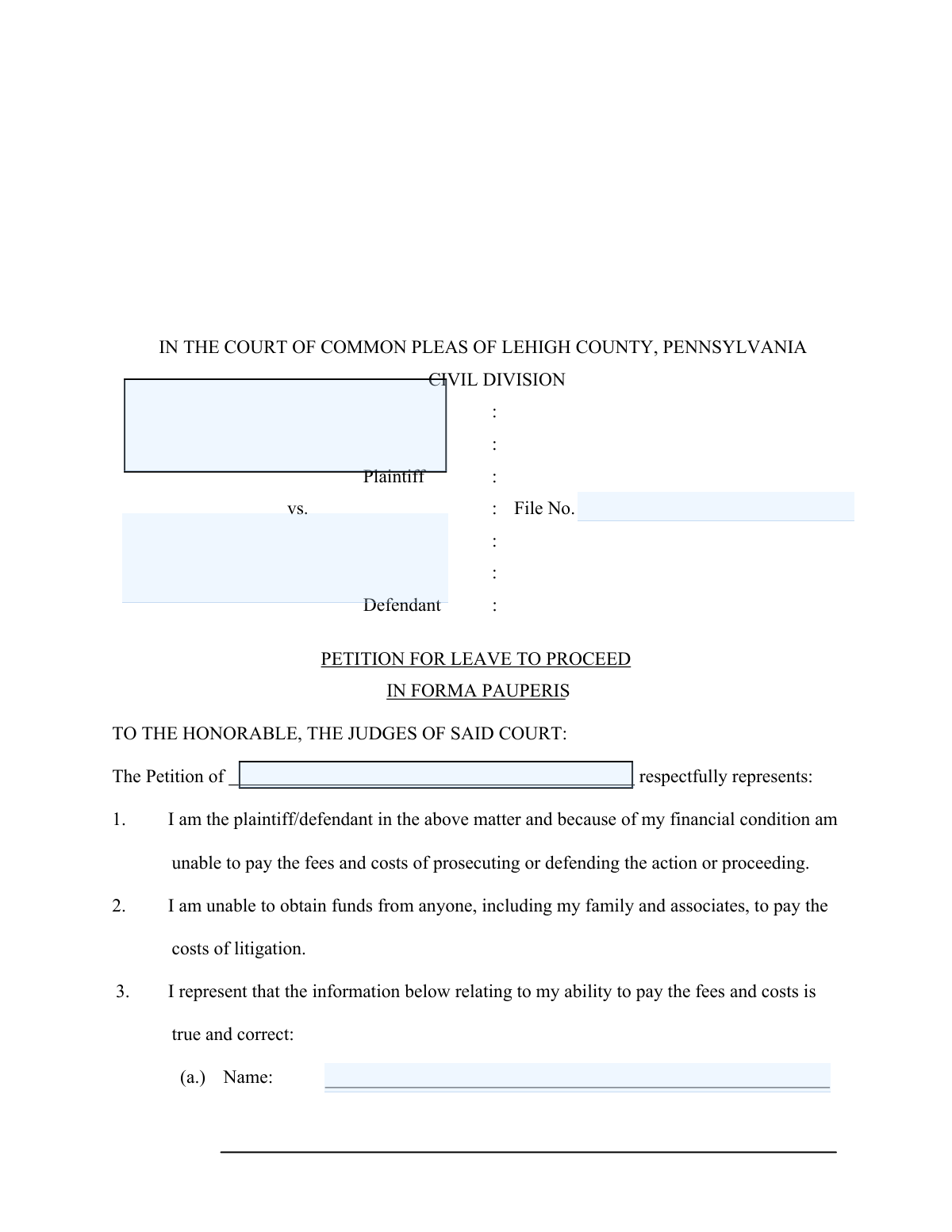

Yes! You can use AI to fill out Petition for Leave to Proceed In Forma Pauperis (Court of Common Pleas of Lehigh County, Pennsylvania, Civil Division)

This is a civil court petition and financial affidavit filed in the Court of Common Pleas of Lehigh County, Pennsylvania, requesting permission to proceed “in forma pauperis” (without paying court fees and costs due to financial hardship). It collects detailed information about your employment status, income sources, household contributions, property, debts, and dependents so the court can determine whether you qualify for a fee waiver. The petition includes a verification under penalty of 18 Pa.C.S. § 4904 (unsworn falsification to authorities), making accuracy critical. If granted, you may be able to file or defend a civil case without paying certain upfront costs, and you must update the court if your finances improve.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Lehigh County IFP Petition (Civil) using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Petition for Leave to Proceed In Forma Pauperis (Court of Common Pleas of Lehigh County, Pennsylvania, Civil Division) |

| Number of pages: | 5 |

| Filled form examples: | Form Lehigh County IFP Petition (Civil) Examples |

| Language: | English |

| Categories: | court forms, financial forms, civil court forms, UK court forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Lehigh County IFP Petition (Civil) Online for Free in 2026

Are you looking to fill out a LEHIGH COUNTY IFP PETITION (CIVIL) form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your LEHIGH COUNTY IFP PETITION (CIVIL) form in just 37 seconds or less.

Follow these steps to fill out your LEHIGH COUNTY IFP PETITION (CIVIL) form online using Instafill.ai:

- 1 Enter the case caption information at the top (plaintiff name, defendant name, and the civil file number if already assigned).

- 2 Identify yourself as the petitioner and indicate whether you are the plaintiff or defendant, then complete your personal contact details (name, address, phone number).

- 3 Complete the employment section: provide current employer, address, monthly wages, and type of work, or if unemployed provide last employment date, prior wages, and type of work.

- 4 List all other income received in the past 12 months (e.g., self-employment, interest/dividends, pension, Social Security, support, disability, unemployment, workers’ compensation, public assistance, and any other sources).

- 5 Provide household support and financial picture: spouse contributions/employment details, contributions from children/parents/others, and list property owned (cash, bank accounts, CDs, real estate, vehicle details with cost and amount owed, stocks/bonds, and other assets).

- 6 Disclose debts and obligations (mortgage, rent, loans, and other recurring obligations) and list all dependents (spouse, children with ages, and other dependents with relationship).

- 7 Review the continuing duty to report improved finances, sign and date the petition/verification, and include your phone number before submitting it to the Lehigh County Court of Common Pleas Civil Division as required.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Lehigh County IFP Petition (Civil) Form?

Speed

Complete your Lehigh County IFP Petition (Civil) in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 Lehigh County IFP Petition (Civil) form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Lehigh County IFP Petition (Civil)

This form asks the Court of Common Pleas of Lehigh County to let you start or defend a civil case without paying filing fees and other court costs because you cannot afford them.

Anyone who is a plaintiff or defendant in the case and cannot afford the fees and costs of the litigation may file it. You must be able to truthfully state you cannot pay and cannot obtain funds from others to pay.

No. You are requesting permission from the court; the judge decides whether to grant IFP status. If granted, certain fees and costs may be waived or deferred as allowed by the court.

Fill in the plaintiff and defendant names exactly as they appear on the case caption and include the File No. (docket number) if you already have one. If you are starting a new case and do not have a file number yet, ask the filing office how to handle that section.

You must provide your name, address, and phone number. Use your current contact information so the court can reach you about the petition and the case.

List your employer’s name and address, your monthly salary or wages, and the type of work you do. Use gross monthly income unless the court or filing office instructs otherwise.

Provide the date of your last employment, what you earned per month at that job, and the type of work you did. If you have never been employed, explain that and provide any relevant details.

Report any income you received in the past 12 months, such as self-employment, interest, dividends, pensions/annuities, Social Security, support payments, disability, unemployment, workers’ compensation, public assistance, or any other source. If a category does not apply, you can write “none” or “$0.”

Yes, the form asks for other contributions to household support, including a spouse’s employment and income and contributions from children, parents, or others. Provide the information requested to give the court a complete picture of household resources.

List cash on hand, checking and savings balances, certificates of deposit, real estate (including your home), vehicles (make, year, cost, and amount owed), stocks/bonds, and any other assets. If you do not own an item, write “none.”

Include your regular financial obligations such as mortgage, rent, loans, and any other significant debts. Providing accurate monthly amounts (if known) helps the court evaluate your ability to pay.

List people who rely on you for financial support, such as a spouse and children (with names and ages), and any other dependents with their relationship to you. Only include individuals you actually support.

The form itself does not list required attachments, but the court may request proof of income, benefits, or assets. If you have documentation available, it can be helpful to bring or submit it if the filing office or judge requires it.

Sign and date the petition where indicated and provide your phone number. By signing, you verify the information is true and understand false statements can lead to penalties under 18 Pa.C.S. § 4904 (unsworn falsification to authorities).

If your financial situation improves after you file, you must inform the court because you may then be able to pay some or all costs. This obligation continues while the case is pending.

Compliance Lehigh County IFP Petition (Civil)

Validation Checks by Instafill.ai

1

Court Caption Completeness (Plaintiff/Defendant Names and File No.)

Validates that the caption includes the full legal names of the Plaintiff and Defendant and a File No. when required by the court/workflow. This is important to ensure the petition is correctly associated with the right case and parties, preventing misfiling or docketing errors. If any caption element is missing or clearly invalid (e.g., placeholder text only), the submission should be flagged for correction before acceptance.

2

Party Role Selection Consistency (Plaintiff vs. Defendant)

Checks that the filer clearly indicates whether they are the plaintiff or defendant (as referenced in statement 1) and that this selection is consistent with the caption (i.e., the petitioner’s name matches the selected role’s party name). This prevents confusion about who is requesting in forma pauperis status and avoids processing the request under the wrong party. If the role is not selected or conflicts with the caption, the form should be rejected or routed for manual review.

3

Petitioner Identity Fields Required (Name, Address, Phone)

Ensures the petitioner’s Name, Address, and Phone Number fields in section 3(a) are completed and not left blank. These fields are necessary for court communication, service-related issues, and verifying the applicant’s identity. If any are missing, the system should require completion or mark the submission incomplete.

4

Phone Number Format Validation (All Phone Fields)

Validates that all phone numbers provided (section 3(a) and the signature block phone number) match an acceptable format (e.g., 10 digits with optional separators, and optional country code if allowed). This is important because invalid phone numbers prevent the court or clerk from contacting the petitioner about deficiencies or hearings. If the phone number fails format checks, the system should prompt correction and prevent final submission.

5

Employment Status Completeness (Employed vs. Unemployed Branch)

Checks that the petitioner completes either the 'presently employed' subsection or the 'presently unemployed' subsection in 3(b), and does not leave both blank. This is critical because employment status is a primary factor in determining ability to pay fees. If neither branch is completed (or both are partially completed in a contradictory way), the submission should be flagged as incomplete or inconsistent.

6

Employer Details Required When Employed

If the petitioner indicates they are presently employed, validates that Employer name, Employer address, Salary/Wages per month, and Type of work are provided. These details support the financial assessment and help prevent underreporting or ambiguity about income. If any required employed-field is missing, the system should require completion or route for review.

7

Last Employment Date Format and Plausibility (When Unemployed)

If the petitioner indicates they are unemployed, validates that 'Date of last employment' is present and is a valid date (e.g., MM/DD/YYYY) and not in the future. This matters because the recency of employment can affect the court’s evaluation of current financial hardship. If the date is invalid or future-dated, the system should block submission until corrected.

8

Monthly Wage/Salary Numeric Validation (All Wage Fields)

Validates that any 'Salary or wages per month' fields (for petitioner and spouse) are numeric currency values (non-negative, reasonable precision such as two decimals) and not text. This is important for consistent calculations and to avoid misinterpretation (e.g., 'one thousand' or '$1,000/mo' with invalid characters if not supported). If the value is non-numeric or negative, the system should prompt correction.

9

Other Income Fields Numeric Validation and Timeframe Consistency

Checks that each 'Other income within the past twelve months' line item (interest, dividends, pension, Social Security, support, disability, unemployment, workers’ compensation, public assistance, other) is either blank or a valid non-negative numeric amount, and optionally enforces a consistent unit (monthly vs. annual) if the system requires it. This is important to prevent mixing units and to ensure the court can accurately assess total resources. If entries contain invalid characters, negative amounts, or inconsistent units where required, the submission should be flagged for correction.

10

Spouse/Household Contribution Logic (Spouse Name vs. Spouse Employment Fields)

Validates that if spouse-related employment or wage fields are filled in section 3(d), the spouse’s name is also provided, and conversely that spouse name alone does not require employer details unless spouse is indicated as employed. This prevents orphaned data and clarifies household support sources. If spouse employment details are present without a spouse name (or vice versa in a way that implies missing required details), the system should request completion or clarification.

11

Assets/Property Numeric and Completeness Validation

Ensures that property owned fields (cash, checking, savings, certificates of deposit, stocks/bonds, other) are numeric non-negative amounts when provided, and that motor vehicle details are complete if a vehicle is listed. This is important because assets are central to determining eligibility for fee waiver and incomplete asset descriptions can conceal value. If a vehicle is indicated but make/year/cost/amount owed are missing (or amounts are invalid), the submission should be flagged as incomplete.

12

Motor Vehicle Year and Amounts Plausibility

If a motor vehicle is listed, validates that the Year is a 4-digit year within a plausible range (e.g., 1900 to current year+1) and that Cost and Amount Owed are valid non-negative currency amounts. This prevents data entry errors like '210' for year or negative debt values. If the year or amounts are out of range or invalid, the system should require correction before submission.

13

Debts and Obligations Numeric Validation (Mortgage/Rent/Loans/Other)

Validates that debts/obligations entries are numeric non-negative amounts and, if the system expects periodic amounts (monthly), enforces that convention consistently. This matters because obligations are weighed against income and assets, and invalid entries can distort the hardship analysis. If any debt field contains non-numeric text or negative values, the submission should be blocked or flagged.

14

Dependents Section Consistency (Names, Ages, Relationships)

Checks that if dependents are listed, each dependent entry includes required attributes (e.g., child name and age; other person name and relationship), and that ages are valid integers within a plausible range (e.g., 0–120). This is important because dependents affect disposable income and eligibility, and incomplete dependent data reduces reliability. If ages are missing/invalid or relationships are omitted where required, the system should prompt for correction.

15

Signature/Verification and Date Required

Ensures the petition includes the petitioner’s signature/attestation (Petitioner line) and a Date, and that the date is in a valid format and not in the future. The verification is legally significant because the petitioner affirms truthfulness under penalty (18 Pa.C.S. § 4904), and unsigned/undated petitions are typically not acceptable. If signature or date is missing or invalid, the submission should be rejected as incomplete.

Common Mistakes in Completing Lehigh County IFP Petition (Civil)

People often focus on the financial sections and forget the case-identifying information at the top, such as Plaintiff/Defendant names and the File No. If the caption is incomplete or doesn’t match the existing docket, the filing can be rejected, misfiled, or delayed while the court tries to confirm which case it belongs to. Copy the caption exactly from your complaint, notice, or prior court paperwork, and include the correct docket/file number if one has already been assigned.

The form states “I am the plaintiff/defendant,” but many filers don’t clearly indicate which role applies to them. This creates confusion about who is requesting fee relief and can lead to processing delays or requests for clarification. Clearly identify your role (plaintiff or defendant) consistent with the caption and the underlying case documents.

Applicants frequently leave the address or phone number blank, use an old address, or provide a number they don’t answer. The court may need to contact you about missing information, scheduling, or an order, and bad contact details can cause you to miss deadlines or hearings. Use your current mailing address (including apartment/unit) and a reliable phone number, and update the court promptly if either changes.

A common mistake is completing both the “presently employed” and “presently unemployed” subsections, or leaving both blank because the applicant is unsure which applies. This makes your financial picture unclear and can result in denial or a request to amend. Choose the one that matches your current status, and if you have irregular work (gig/seasonal), explain it under employment or “Other income” with dates and average monthly amounts.

The form asks for “salary or wages per month,” but people often enter weekly or yearly figures, or mix gross and net pay without stating which. Inconsistent numbers can make the affidavit look unreliable and may trigger follow-up questions or denial. Convert your pay to a monthly amount (and note if it’s gross or net), and keep the same time period (monthly) across all income fields.

Applicants frequently forget to include benefits and non-wage income such as unemployment compensation, Social Security, disability, support payments, workers’ compensation, or public assistance. Missing income sources can be treated as an incomplete or inaccurate affidavit and may expose the filer to penalties if the omission is viewed as intentional. Review each line item for the past 12 months and enter an amount (or “none”) for each category, adding brief notes if the income is sporadic.

Many people only report their personal income and skip the section on “Other contributions to household support,” especially if a spouse, partner, parents, or children help with bills. Courts often consider household resources when evaluating ability to pay, so leaving this blank can lead to denial or requests for more information. List who contributes, their employment (if applicable), and the approximate monthly amount or type of support (rent, groceries, utilities).

It’s common to list only cash on hand and forget checking/savings balances, certificates of deposit, stocks/bonds, or ownership interests in a home or vehicle. If assets are missing or obviously incomplete, the court may question credibility and require an amended petition or deny IFP status. Use current balances and include all property you own (even jointly), and for vehicles include make, year, cost/value, and the amount owed as requested.

People often write “rent,” “loans,” or “mortgage” but don’t provide the monthly payment or the amount owed, or they omit recurring obligations like utilities, child support, medical bills, or credit cards (if “Other” applies). Without clear debt figures, the court can’t accurately assess your ability to pay fees and costs. Provide specific monthly payment amounts and/or outstanding balances where relevant, and use the “Other” line to capture significant recurring obligations not explicitly listed.

Applicants sometimes list “children” without names/ages, forget to include other dependents (elderly parents, disabled relatives), or leave the relationship field blank. Dependents affect disposable income and the court’s evaluation, so incomplete entries can reduce the weight of your financial hardship claim. List each dependent with required details (name and age for children; name and relationship for others) and ensure it matches your household support information.

A frequent filing error is forgetting to sign, date, or complete the verification language, or treating the form as informal rather than a sworn statement. Unsigned or undated petitions are commonly rejected, and inaccurate statements can carry criminal penalties under 18 Pa.C.S. § 4904. Sign and date where indicated, read the verification carefully, and double-check that all entries are truthful and complete before submitting.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Lehigh County IFP Petition (Civil) with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills petition-for-leave-to-proceed-in-forma-pauperis-co forms, ensuring each field is accurate.