Yes! You can use AI to fill out State of Illinois Department of Human Services (IDHS) – Bureau of Child Care and Development Child Care Application (Form IL444-3455)

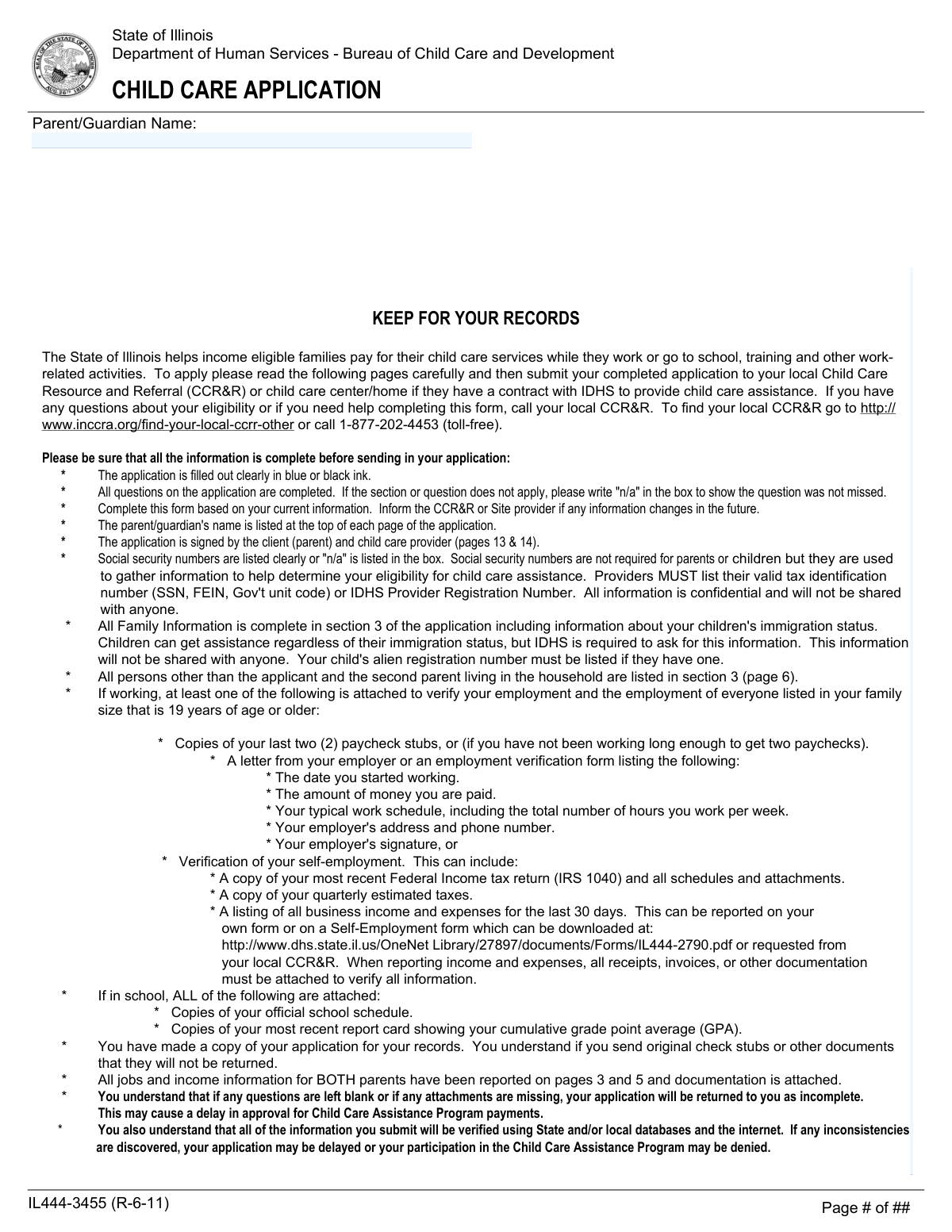

Form IL444-3455 is the official Illinois Department of Human Services Child Care Application used to determine eligibility for child care assistance and to set the approved child care schedule and parent co-payment. It collects parent/guardian and household details, work/school activity information, family composition and citizenship/immigration documentation (as applicable), provider information, and monthly income. The form also includes required certifications and signatures from both the parent/guardian and the child care provider, which are necessary for IDHS to authorize payments. Submitting a complete application with required verifications (such as pay stubs or school schedules) helps avoid delays or return of the application as incomplete.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out IL444-3455 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | State of Illinois Department of Human Services (IDHS) – Bureau of Child Care and Development Child Care Application (Form IL444-3455) |

| Number of pages: | 17 |

| Filled form examples: | Form IL444-3455 Examples |

| Language: | English |

| Categories: | immigration forms, CAR forms, child care forms, Illinois state forms, OPM forms, IDHS forms, human services forms, PA state forms, L.A. Care forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out IL444-3455 Online for Free in 2026

Are you looking to fill out a IL444-3455 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your IL444-3455 form in just 37 seconds or less.

Follow these steps to fill out your IL444-3455 form online using Instafill.ai:

- 1 Enter parent/guardian contact information and identifiers (address, phone/email, optional SSN, case numbers if applicable) and indicate whether multiple providers are involved.

- 2 Complete work and/or school/training/TANF-required activity sections for the applicant (and for the other parent/stepparent if living in the home), including employer details, pay frequency, hours, schedules, and travel time.

- 3 List all household members and the children needing assistance in the Family Information section, including required federal reporting items (e.g., ethnicity) and citizenship/alien registration details if applicable.

- 4 Fill out a Child Care Arrangement (Section 4) for each provider you want paid, listing each child’s care schedule (and school hours if applicable), rates, and whether schedules vary or discounts apply.

- 5 Report total gross monthly income by type for all counted family members (employment, self-employment, child support, TANF, Social Security/other income) and subtract child support paid; attach required income and activity verifications (pay stubs, employer letter, tax/self-employment records, school schedule, GPA/report card, etc.).

- 6 Have the child care provider complete the Provider Information sections (tax ID/registration number, provider type/licensing details, household members if required, and required disclosures), then obtain the provider’s signature and date.

- 7 Review all certifications, sign and date the Parent/Guardian Certification (and other parent signature if required), make a copy for your records, and submit the full packet to your local CCR&R or contracted site provider.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable IL444-3455 Form?

Speed

Complete your IL444-3455 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 IL444-3455 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form IL444-3455

This application is used to request help from the Illinois Department of Human Services (IDHS) to pay for child care while you work, attend school, training, or other approved work-related activities.

Income-eligible working families, TANF clients in approved activities, teen parents in school/GED programs, and income-eligible families in school or training should apply. A child’s legal guardian or relative caring for the child may also apply (foster parents generally receive assistance through DCFS).

Submit the completed application to your local Child Care Resource & Referral (CCR&R) agency, or to a child care center/home if it has an IDHS contract to provide child care assistance. To find your CCR&R, visit inccra.org or call 1-877-202-4453.

Yes. The form states you must have a child care provider selected before submitting your application because provider and schedule information are required.

No. Parent and child Social Security Numbers are optional and eligibility will not be denied if you do not provide them; you can write “n/a.” However, providers must list a valid tax identification number (SSN, FEIN, Gov’t unit code) or an IDHS Provider Registration Number.

Attach at least one of the following for each working adult (age 19+) counted in family size: two most recent consecutive pay stubs, or an employer letter/employment verification with start date, pay, schedule/hours, employer contact info, and signature. If self-employed, attach tax returns/estimated taxes or a 30-day income/expense statement with receipts/invoices.

You must report all jobs even if you don’t need child care for every job. Photocopy the Work Information page and complete a separate work and schedule section for each job.

Provide an example schedule on the form and explain how it varies. You may also submit additional pay stubs or other documentation to help establish an average schedule.

You must attach copies of your official school schedule and your most recent report card showing your cumulative GPA. The form also asks you to complete the school/training schedule section.

Yes. If the other parent/stepparent lives in the home, they must be listed and generally must also be working or in school/training/TANF-required activity; they must complete their sections and provide documentation. If they are not participating, you must explain why they cannot care for the children.

Family size includes people living in your home: you, your biological/adopted children under 21, the other parent of any child in the home, and certain relatives you support more than 50% (if you choose to include them and can verify their income). You must also list any other household members counted in family size who are not already listed elsewhere.

Children can receive assistance regardless of immigration status, but IDHS is required to ask for citizenship/immigration information. If a child has an alien registration number, list it if available; the form states this information is confidential and not shared.

List only the hours the child is actually in child care with the provider on this application (do not include hours the child is in school). If you have more than one provider, you must complete a separate Section 4 for each provider.

Yes. IDHS requires a monthly parent co-payment paid directly to your provider, based on gross monthly income, family size, and number of children in care; the amount will be listed on your approval letter.

You and your provider will be notified of approval or denial within 30 days after the CCR&R receives a completed application and all required documents. Incomplete applications (blank questions or missing attachments) are a common reason for delays and may be returned.

Compliance IL444-3455

Validation Checks by Instafill.ai

1

Required Parent/Guardian Identity Fields Completed

Validate that the applicant’s first name, last name, date of birth, and sex selection (male/female) are provided, and that the parent/guardian name appears where required (top of each page in the form set). These fields establish the primary case identity and are needed for eligibility determination and record matching. If missing or illegible/blank, the submission should be flagged as incomplete and returned for correction.

2

Address Completeness and Illinois Address Format Validation

Check that the home address includes street, city, state, and ZIP code, and that the state is a valid two-letter code (typically IL for Illinois). Validate ZIP code format (5 digits or ZIP+4) and ensure apartment number is present when indicated. Address accuracy is critical for notices, CCR&R routing, and cross-database verification. If invalid, the system should reject the address and require correction before processing.

3

Phone Number and Email Format Validation

Validate that at least one reachable phone number is provided (home, mobile, or alternate) and that all phone numbers follow a valid US format (10 digits, optional extension). If an email address is provided, validate it against standard email syntax rules. Reliable contact information is necessary to resolve missing documentation and prevent processing delays. If validation fails, prompt the applicant to correct the format or provide an alternate contact method.

4

Optional SSN Field Rules (Parent/Children) and Placeholder Handling

If a Social Security Number is entered for a parent or child, validate it is exactly 9 digits (or formatted as XXX-XX-XXXX) and not an obviously invalid value (e.g., all zeros). If not provided, ensure the field is blank or explicitly marked as 'N/A' per form instructions, and do not treat it as a required field. This prevents data-entry errors while respecting that SSNs are optional for eligibility. If an SSN is partially entered or malformed, the submission should be flagged for correction to avoid mismatches in verification.

5

Other Benefits Case Number and County Field Consistency

When a TANF/SNAP/Medical Assistance case number is provided, validate it matches expected numeric/alpha format and that a county is selected/entered. County and case number are used for cross-program verification and routing. If a case number is present but county is missing (or vice versa where required by workflow), the system should request completion or confirm the applicant is not applying with an existing case.

6

Work Information Completeness Per Job (Applicant and Other Parent)

If the applicant (or other parent) indicates they are working or lists a number of jobs greater than zero, require completion of employer name, job title, employer address, start date, pay amount, pay frequency, and typical hours/days per week for each job. Also require at least one work schedule example (FROM/TO with days) or a clear explanation that the schedule varies. This information drives eligibility and authorized care hours. If any required job fields are missing for a declared job, the application should be marked incomplete.

7

Employment Pay Rate and Pay Frequency Logical Validation

Validate that exactly one pay basis is selected (per year/per month/per hour) and that the numeric amount is positive and within reasonable bounds (e.g., not negative, not zero when working is claimed). Validate that a pay frequency is selected (weekly, every two weeks, twice per month, or 'other' with explanation). Correct pay structure is necessary to compute monthly income consistently. If multiple bases are selected or none are selected, the system should require correction before income calculations proceed.

8

Date Field Format and Chronology Validation (DOB, Job Start, Term Dates, Provider Start)

Validate all dates are in MM/DD/YYYY format and represent real calendar dates. Enforce logical chronology: job start dates cannot be in the future (unless explicitly allowed by policy), school term start must be on/before term end, and provider care start date should not be unreasonably far in the past relative to application submission. Date accuracy is essential for eligibility windows and verification. If dates are invalid or inconsistent, the system should block submission or route to exception review.

9

School/Training Section Conditional Requirements

If the applicant (or other parent) answers 'Yes' to attending school/training/TANF-required activity, require the education/training type selection, school/program name, address/phone (if captured), term start/end dates, and a completed school schedule (FROM/TO with days) or documented explanation of variability. If 'No' is selected, ensure school fields are blank or 'N/A' to avoid contradictory data. This ensures the activity requirement for eligibility is properly documented. If conditional fields are missing, the application should be returned as incomplete.

10

Other Parent/Stepparent Household Presence and Activity Consistency

If the applicant indicates the other parent/stepparent lives in the home, require completion of that person’s identity fields (name, DOB, phone) and their work and/or school/training status details. If they are neither working nor in school/training, require a non-empty explanation of why they cannot care for the children. Program rules require both adults in a two-parent household to meet activity requirements or provide an acceptable exception. If the section is incomplete or contradictory, the case should be flagged for follow-up and may be denied if not resolved.

11

Family Size and Household Member Listing Reconciliation

Validate that the declared 'My family size' equals the count of individuals listed across the applicant, other parent (if in home), children, and any additional household members included in family size. Ensure no duplicate persons are listed and that each listed person has required attributes (name, DOB, relationship, sex, ethnic origin where required). Family size directly affects income eligibility thresholds and copayment calculations. If counts do not reconcile, the system should require correction or route to manual review.

12

Child Eligibility Age and Special Condition Validation

Validate each child’s date of birth and compute age; flag children age 13 or older for additional required documentation indicators (court supervision or medical documentation of incapacity) per program rules. Also ensure each child needing assistance is explicitly listed in the 'I need child care assistance for the following children' section. This prevents authorizing care for ineligible ages without required exceptions. If an over-age child is included without exception documentation, the application should be flagged and not approved until resolved.

13

Ethnic Origin Coding and Multi-Code Format Validation

Validate that each child has an ethnic origin entry using only the allowed codes (1–6) and that multi-code entries follow the specified format (e.g., '3-1', '3-2', '3-5' when Hispanic is selected along with race). This is required for federal reporting and data quality. If codes are missing or outside the allowed set, the system should prompt correction rather than silently accepting invalid values.

14

Child Care Provider Identification and Tax ID Requirement

Require a provider name and either an IDHS Provider Registration Number or a valid tax identifier (SSN/FEIN/Gov’t unit code) as indicated by the provider type. Validate SSN/FEIN formats (SSN 9 digits; FEIN 9 digits, often formatted XX-XXXXXXX) and ensure only one identifier type is selected/filled unless policy allows multiple. Provider identification is mandatory for payment and W-9/Comptroller setup. If missing or invalid, the application cannot proceed to authorization and should be returned.

15

Provider Type vs Licensing Fields Consistency

Validate that the selected provider type (licensed center/home/group home, license-exempt relative/non-relative, etc.) is consistent with the licensing information provided. If a licensed type is selected, require license number, capacity, expiration date, and hours of operation; if license-exempt is selected, ensure licensing fields are blank and that required household member listing is completed when care is in provider’s home. This prevents misclassification that could bypass required checks or apply wrong rate rules. If inconsistent, route to correction or manual review.

16

Child Care Schedule Integrity and School-Time Exclusion

For each child listed under a provider, validate that FROM/TO times are present for any day care is requested, that times are in a valid AM/PM format, and that FROM is earlier than TO. If the child attends school, require school hours and validate that requested child care hours do not overlap with school hours (per certification that care does not include school time). Schedule accuracy is essential for determining authorized hours and preventing improper payments. If overlaps or invalid time ranges are detected, the system should flag the schedule and require correction.

17

Monthly Income Totals and Non-Negative Amount Validation

Validate that all income entries are numeric currency amounts (or 'N/A' where allowed), non-negative, and that the subtotal equals the sum of lines 1–6. Validate that child support paid is entered as a non-negative amount and is subtracted correctly from the subtotal to produce the total monthly income, and that housing cash assistance is captured separately and not included in total family income. Accurate income math is central to eligibility and copayment determination. If calculations do not reconcile, the system should recalculate and/or require applicant confirmation before submission.

18

Required Signatures and Dates Present (Parent and Provider)

Require the parent/guardian signature and date in Section 8 and the child care provider signature and date in Section 7; if an other parent signature line is present and the other parent is part of the household/case, require their signature per policy/workflow. Validate signature dates are present and in valid date format. Signatures are legal attestations and authorizations for verification and payment processing. If missing, the application should be rejected as incomplete and not processed.

Common Mistakes in Completing IL444-3455

Applicants often skip questions they think don’t apply (e.g., income types, school/training sections, provider questions) and leave fields empty. This form explicitly instructs you to write “n/a” so reviewers can tell the question wasn’t missed. Blank fields commonly cause the application to be returned as incomplete, delaying approval. To avoid this, scan every section and write “N/A” anywhere a question does not apply to your household or provider.

Because the application is multiple pages and may be separated during processing, people frequently forget to repeat the Parent/Guardian Name on each page header. Missing names can lead to pages being misfiled or treated as belonging to a different case, which slows processing and triggers requests for resubmission. Before submitting, flip through the packet and ensure the Parent/Guardian Name line is completed on every page that has it.

Applicants sometimes use pencil, red ink, or faint ink, or they write too small, making key numbers (dates, SSNs, case numbers, schedules) hard to read. Illegible entries often get interpreted incorrectly or require staff to return the form for clarification, delaying benefits. The form requires typing or printing clearly in blue or black ink. Use block letters, avoid cross-outs, and rewrite any page that becomes messy.

A very common error is entering take-home pay (after deductions) or weekly/biweekly amounts in Section 5, even though it asks for average gross MONTHLY income. This can make the household appear incorrectly eligible/ineligible and can cause verification mismatches with pay stubs and databases, delaying or denying the case. Use pay stubs to calculate gross monthly income (before deductions) and convert correctly based on pay frequency, and ensure tips are included when applicable.

People often forget to attach the last two most recent consecutive pay stubs for each working adult age 19+ counted in family size, or they attach screenshots/partial stubs missing employer name, dates, or gross pay. Without proper verification, the application is typically returned as incomplete or held until documents arrive. Attach two consecutive stubs for each job, and if newly employed, include an employer letter with start date, pay rate, typical schedule/hours per week, employer contact info, and signature.

Applicants sometimes list only the job they think “needs child care,” but the form requires all jobs even if child care isn’t needed for that job. Others forget to photocopy and complete an additional work information/schedule page for each job. Omitting jobs can create income and schedule inconsistencies during database checks and can reduce or miscalculate approved care hours. List every job, complete a separate work section for each, and ensure schedules and pay documentation match each job listed.

Schedules are frequently left vague (e.g., “varies” with no example), missing AM/PM, or showing times that don’t align with pay stubs, employer letters, or school schedules. Applicants also forget to include travel time fields or public transportation answers, which are used to determine allowable care hours. Inconsistencies can trigger follow-up requests or reduced approved hours. Provide a clear example week, mark AM/PM for every day, explain variability in writing, and include reasonable travel time consistent with your commute.

Many applicants skip Section 2 even when another parent/stepparent lives in the household, or they don’t provide that person’s work/school status and documentation. The program generally requires both adults in a two-parent household to be working or in an approved activity, and missing information can delay or prevent approval. If the other parent is not working/in training, the form requires an explanation of why they cannot care for the children, often needing a signed statement. Confirm household composition and fully complete pages for the other parent, including their jobs, schedules, and verifications.

Applicants often misunderstand “family size” and either leave out adults living in the home, fail to list other household members on the family information page, or don’t include required income for those counted. This can change eligibility and co-payment amounts and can cause mismatches with state databases (SNAP/TANF/medical records, unemployment, etc.). Carefully follow the definition: include you, your children under 21, the other parent of any child in the home, and any other person you count because you support them (with verifiable income). List all household members as instructed, especially anyone age 19+ whose income must be reported if counted.

Common issues include wrong or incomplete dates of birth, missing relationship to applicant, leaving ethnicity origin blank, or entering ethnicity text instead of the required numeric codes (including the special instruction for Hispanic ethnicity plus race, e.g., “3-1”). Applicants also sometimes skip the citizenship question or fail to provide an alien registration number/documentation when available, even though the form requires asking. These mistakes can slow processing and lead to requests for corrections. Use official documents for DOB spelling, follow the numeric ethnicity code instructions exactly, and provide alien registration information if the child has it (children may still qualify regardless of status).

Applicants frequently list total daily time away from home rather than the hours the child is actually with the specific provider, and they forget to exclude hours the child is in school/Head Start/Pre-K. Others list multiple providers but do not complete a separate Section 4 schedule for each provider as required. This can result in incorrect authorized hours and payment issues for the provider. For each provider, list only the children cared for by that provider and only the hours in that provider’s care (excluding school hours), and complete a separate Section 4 for every provider you want paid.

A frequent last-step error is submitting the packet without the required parent/guardian certification signature/date and the provider certification signature/date. Providers also sometimes omit the required valid tax identification number (SSN/FEIN/Gov’t unit code) or IDHS Provider Registration Number, which is mandatory for payment setup. Missing signatures or tax/registration information can stop the case from being approved or prevent the provider from being paid even if the family is eligible. Before submitting, confirm all signature lines are signed and dated and that the provider has completed their section fully, including the correct tax ID/registration number and any required licensing details.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out IL444-3455 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills state-of-illinois-department-of-human-services-idh forms, ensuring each field is accurate.