Yes! You can use AI to fill out Texas Real Estate Commission (TREC) One to Four Family Residential Contract (Resale) (TREC No. 20-18)

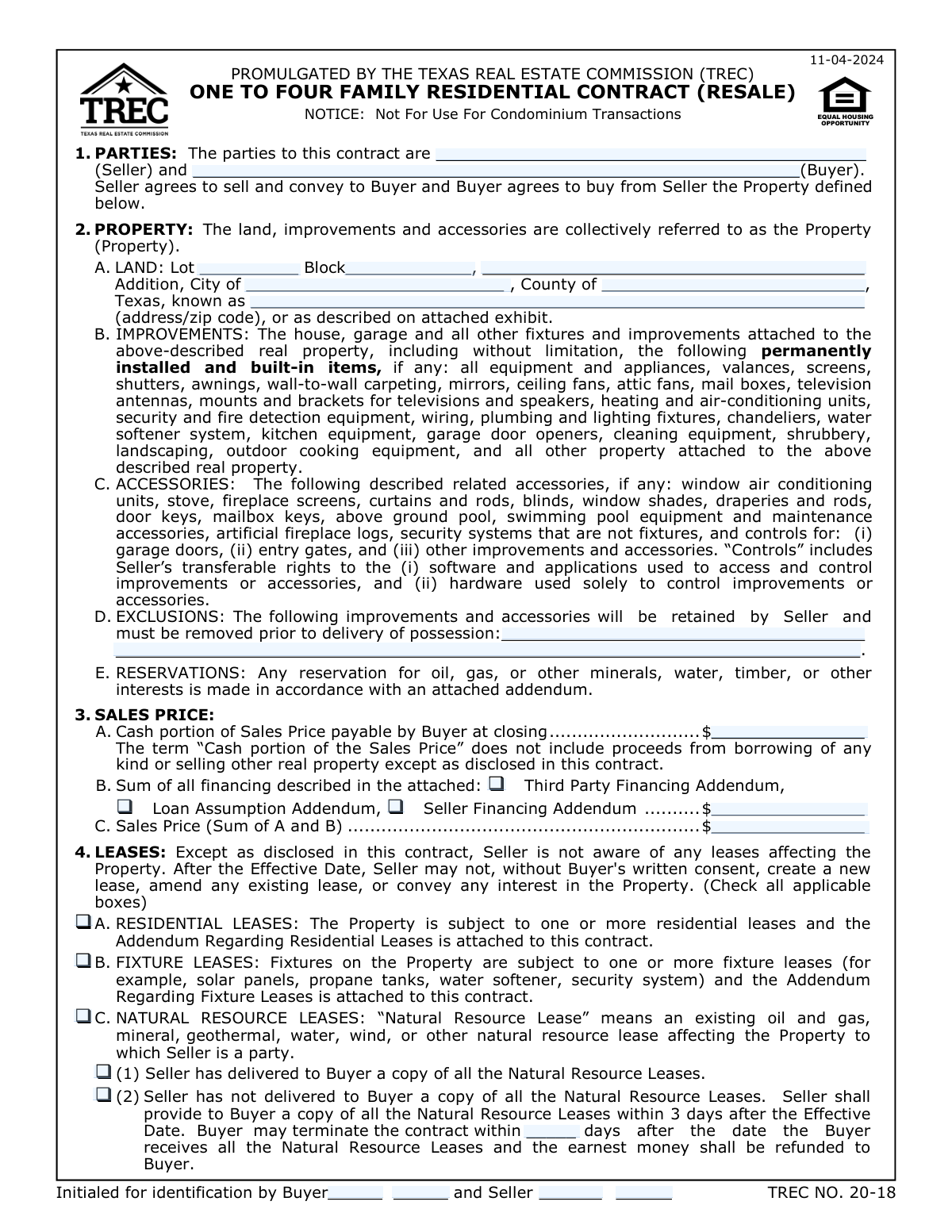

The TREC One to Four Family Residential Contract (Resale) is the Texas Real Estate Commission’s promulgated purchase contract used for resale transactions involving one-to-four family residential properties (not condominiums). It sets the legally binding terms between the Seller and Buyer, including the property description, sales price and financing, earnest money and option period, title policy and survey obligations, disclosures, repairs, closing, and default remedies. Because it controls deadlines, termination rights, and required notices/addenda, accurate completion is critical to protect both parties and keep the transaction enforceable and on schedule.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out TREC 20-18 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Texas Real Estate Commission (TREC) One to Four Family Residential Contract (Resale) (TREC No. 20-18) |

| Number of pages: | 11 |

| Filled form examples: | Form TREC 20-18 Examples |

| Language: | English |

| Categories: | real estate forms, estate forms, TREC forms, Texas real estate forms, real estate contracts, residential contract forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out TREC 20-18 Online for Free in 2026

Are you looking to fill out a TREC 20-18 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your TREC 20-18 form in just 37 seconds or less.

Follow these steps to fill out your TREC 20-18 form online using Instafill.ai:

- 1 Enter the parties and property details: fill in Seller/Buyer names, the property address, and the legal description (lot/block/addition/city/county) and attach any required exhibits.

- 2 Define what conveys with the sale: confirm improvements/accessories included, list any exclusions to be removed by Seller, and note any mineral/water/timber reservations via the appropriate addendum.

- 3 Complete the financial terms: fill in the sales price breakdown (cash portion and financing), select and attach the correct financing addendum(s), and specify escrow agent, earnest money, option fee, and any additional earnest money with delivery deadlines.

- 4 Set contract timelines and contingencies: choose the option period length, complete title policy responsibility, title company, commitment delivery timing, survey choice (existing/new and who pays), and objection/cure periods.

- 5 Disclosures and property condition: indicate Seller’s Disclosure Notice status, address lead-based paint requirements (if pre-1978), select the “As Is” option and list any specific agreed repairs/treatments, and include any required statutory notices/addenda (HOA, districts, coastal, propane, etc.).

- 6 Closing, possession, and expenses: enter the closing date, possession method (at closing or via temporary lease), allocate settlement costs/credits, prorations, and any special provisions permitted by the form.

- 7 Attach addenda and finalize execution: check all applicable addenda boxes, complete notices/attorney contact sections, obtain initials/signatures and the effective date, and ensure escrow receipts (earnest money/option fee/additional earnest money) are completed as funds are delivered.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable TREC 20-18 Form?

Speed

Complete your TREC 20-18 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 TREC 20-18 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form TREC 20-18

This form is the standard Texas Real Estate Commission (TREC) contract used to document the terms of a resale purchase of a 1–4 family residential property. It sets out the parties, property description, price, financing, title/survey requirements, disclosures, deadlines, and closing terms.

It is intended for use by trained Texas real estate license holders representing a buyer and/or seller in a residential resale transaction. Buyers and sellers sign it, but brokers/agents typically prepare it and fill in the blanks based on the negotiated deal.

No. The form states it is not for use for condominium transactions, which typically require different contract forms and disclosures.

The “Property” includes the land, improvements (like the house and built-in fixtures), and listed accessories (like keys, remotes, certain window coverings, and pool equipment if applicable). Items the seller wants to keep must be listed under “Exclusions” so there is no confusion.

List anything the seller will retain in Paragraph 2D (Exclusions) and ensure it is removed before possession is delivered. If something is not excluded and is a fixture or listed accessory, it is generally treated as included.

The sales price is the sum of (A) the cash portion paid at closing plus (B) the total financing described in any attached financing addendum (third-party loan, assumption, or seller financing). The “cash portion” excludes loan proceeds unless disclosed through the financing sections/addenda.

Earnest money is a deposit held by the escrow agent to support the buyer’s performance, and the option fee is paid for the buyer’s unrestricted right to terminate during the option period. Both must be delivered within 3 days after the Effective Date to the named escrow agent, and missing the option fee deadline can eliminate the buyer’s option right.

The option period is a negotiated number of days after the Effective Date during which the buyer can terminate for any reason by giving notice by 5:00 p.m. local time where the property is located. If the buyer terminates on time, the option fee is not refunded, but the earnest money is refunded.

If earnest money is not delivered on time, the seller may terminate the contract (or pursue other remedies) if the seller gives notice before the buyer delivers it. If the option fee is not stated or not delivered on time, the buyer does not have the unrestricted termination right under Paragraph 5.

Paragraph 6A specifies whether the seller or buyer pays for the owner’s title policy. The seller must provide the title commitment and exception documents within 20 days after the title company receives the contract (with limited automatic extensions), and if they are not delivered in time, the buyer may be able to terminate and receive a refund of earnest money.

Paragraph 6C controls the survey: either the seller provides an existing survey plus a T-47 affidavit/declaration, the buyer orders a new survey, or the seller orders a new survey. If an existing survey/T-47 is not provided or not accepted by the title company or lender, a new survey may be required and the contract specifies who pays.

Under Paragraph 6D, the buyer must object in writing by the earlier of the Closing Date or the stated number of days after receiving the commitment, exception documents, and survey. If the buyer does not object in time, most objections are waived (Schedule C requirements are not waived).

Common required items include the Seller’s Disclosure Notice (Texas Property Code §5.008), lead-based paint disclosures for homes built before 1978, and various district/utility/HOA notices depending on the property. The contract notes that failure to provide applicable statutory notices may give the buyer remedies or termination rights.

“As Is” means the buyer accepts the property in its present condition without warranties except those in the contract (including title warranties). The buyer can still inspect, negotiate specific repairs via amendment, or terminate during the option period if one is included.

Possession is typically delivered upon closing and funding unless a temporary lease is used for buyer or seller possession. At possession, the seller must provide access information for smart devices (codes/usernames/passwords/apps) and remove the seller’s access from personal devices.

Compliance TREC 20-18

Validation Checks by Instafill.ai

1

Validates Seller and Buyer names are present and consistently used throughout the contract

Checks that the Seller and Buyer fields in Paragraph 1 are completed with full legal names (not blank, not initials only) and that the same parties are referenced consistently anywhere else the form repeats “Buyer”/“Seller” signature blocks. This is important because party identity is fundamental to enforceability and to prevent mismatches with title, lender, and escrow records. If missing or inconsistent, the submission should be rejected or flagged for correction before execution.

2

Ensures Property legal description fields are complete (Lot/Block/Addition/City/County/Address/ZIP)

Validates that Paragraph 2A includes either a complete platted legal description (Lot, Block, Addition, City, County, Texas) plus the street address and ZIP, or explicitly references an attached exhibit that contains the legal description. This prevents ambiguity about what is being conveyed and supports title commitment and deed preparation. If any required components are missing and no exhibit is attached, the form should fail validation and require completion.

3

Checks Exclusions and Reservations are not left ambiguous when referenced

If Paragraph 2D (Exclusions) contains any text, validate it is specific (identifies items clearly) and not generic phrases like “personal property” without detail; if blank, ensure it is truly intended as no exclusions. If Paragraph 2E indicates reservations are made via an attached addendum, validate that the referenced minerals/water/timber reservation addendum is actually included in the addenda list. If ambiguity or missing addendum is detected, flag as high risk because it can materially change what transfers at closing.

4

Validates Sales Price math and required amounts (Cash + Financing = Sales Price)

Checks that Paragraph 3A (cash portion), 3B (financing sum), and 3C (sales price) are all present, numeric, non-negative currency values, and that 3C equals 3A + 3B. This is critical for closing statements, lender underwriting, and to avoid disputes about consideration. If the math does not reconcile or any amount is missing, the submission should be blocked until corrected.

5

Ensures financing addenda selection matches financing amount and type

If Paragraph 3B is greater than $0, validate that at least one financing addendum checkbox is selected (Third Party Financing, Loan Assumption, or Seller Financing) and that the selected addendum(s) are included in the addenda section. Conversely, if 3B is $0, validate that no financing addendum is selected unless explicitly required for another reason. If mismatched, flag because it creates uncertainty about financing obligations and termination rights.

6

Validates Lease disclosures and required lease addenda when boxes are checked

Checks Paragraph 4 selections: if Residential Leases is checked, the Addendum Regarding Residential Leases must be attached; if Fixture Leases is checked, the Addendum Regarding Fixture Leases must be attached. For Natural Resource Leases, validate that either (1) or (2) is selected (not both, not neither), and if (2) is selected, the termination-days blank is completed with a valid integer. If any required addendum or required sub-selection is missing, fail validation because lease obligations materially affect possession and title.

7

Earnest Money/Option Fee delivery fields completeness and deadline logic

Validates Paragraph 5A includes Escrow Agent name, escrow address, earnest money amount, and option fee amount (option fee may be $0 only if the parties intend no option, but then Paragraph 5B should not grant an option period). Also validates any additional earnest money clause (5A(1)) has both the amount and the number of days filled in when used. If required fields are blank or contradictory, flag because it affects contract formation, termination rights, and escrow handling.

8

Option Period requires a stated number of days and a non-zero Option Fee

Checks Paragraph 5B for a completed Option Period day count (positive integer) whenever an option is intended, and cross-checks Paragraph 5A to ensure a dollar amount is stated for the Option Fee and is greater than $0. This is important because the form states that if no option fee is stated or timely delivered, the unrestricted termination right does not exist. If an option period is filled but the option fee is blank/zero, the system should flag a logical inconsistency requiring correction or explicit acknowledgement.

9

Title Policy payer selection and Title Company identification validation

Validates Paragraph 6A has exactly one box checked for who pays (Seller or Buyer) and that the Title Company name is provided. This ensures the parties’ cost allocation is clear and the commitment/policy can be ordered from an identified provider. If both/neither payer boxes are checked or the Title Company is missing, fail validation because closing cannot be properly coordinated.

10

Survey election is exclusive and required dependent fields are completed

Checks Paragraph 6C to ensure exactly one of the three survey options is selected. For the selected option, validates the associated “within ___ days after Effective Date” blank is completed with a positive integer, and if option 6A(8)(ii) is selected, exactly one of Buyer/Seller expense boxes is checked. If multiple survey options are checked or required day counts are missing, flag because it impacts title objections and closing readiness.

11

Title objections deadline and prohibited-use blank validation

Validates Paragraph 6D includes a filled-in number of days for the objection period (positive integer) and that the “use or activity” blank is either completed with a specific intended use or intentionally left blank only if the parties accept no special use protection. This is important because objection timing drives termination/waiver rights and lender/title workflows. If the days blank is empty, the contract’s objection mechanism becomes unclear and should be rejected for completion.

12

Seller’s Disclosure Notice selection is exclusive and delivery deadline is present when required

Checks Paragraph 7B to ensure exactly one of the three boxes is selected. If “Buyer has not received the Notice” is selected, validate the delivery deadline (___ days after Effective Date) is completed with a positive integer. If multiple boxes are checked or the deadline is missing, flag because it affects statutory termination rights and compliance with Texas Property Code §5.008.

13

As-Is acceptance selection is exclusive and repair list is specific when required

Validates Paragraph 7D has exactly one box checked (As Is or As Is with specific repairs). If the repairs option is selected, checks that the repair/treatment text is non-empty and contains specific items (e.g., “replace roof shingles on west slope”) rather than generic contingencies like “subject to inspections.” If invalid, flag because vague repair language creates disputes and may be considered unenforceable or misleading.

14

Closing Date format and chronological consistency with Effective Date

Checks Paragraph 9A for a valid calendar date (month/day/year or clearly formatted date) and ensures it is not earlier than the Effective Date. This is important for performance deadlines (repairs, title delivery, option period, objections) and for lender/escrow scheduling. If the closing date is missing or precedes the effective date, fail validation and require correction.

15

Possession selection requires a valid choice and lease addendum when applicable

Validates Paragraph 10A has exactly one possession option selected: upon closing and funding, or according to a temporary residential lease. If the lease option is selected, validate that the appropriate temporary residential lease form (Buyer’s or Seller’s Temporary Residential Lease) is included/checked in the addenda list and that it is attached. If missing, flag because possession terms are a major risk area and must be documented to avoid tenancy-at-sufferance issues.

16

Notices and contact information fields validate phone/email formats when provided and require at least one delivery method

Checks Paragraph 21 contact blocks (Buyer, Seller, attorneys, and agents) to ensure that any provided phone numbers follow a valid 10-digit format, emails are syntactically valid, and fax numbers (if provided) are valid. Also validates that each party has at least one usable notice delivery channel (mailing address and/or email/fax) to satisfy the contract’s notice requirements. If contact info is unusable or entirely missing, flag because notice effectiveness and deadline enforcement depend on it.

Common Mistakes in Completing TREC 20-18

People often leave Paragraph 1 blank or enter nicknames, missing middle initials, or the wrong legal entity name (e.g., writing an individual when title is held by an LLC or trust). This creates signing/authority problems and can delay closing when the title company requires the exact vesting names. Use the full legal names exactly as they appear on the current deed and include entity type (LLC, LP, trust) and signer authority where applicable.

A very common error is entering only the street address and skipping the Lot/Block/Addition, county, or city fields in Paragraph 2A, or copying the wrong legal description from a listing. Title work and the deed rely on the legal description; mistakes can cause title objections, re-drafting, or even closing delays. Pull the legal description from the current deed, tax records, or the title commitment, and attach an exhibit if the space is insufficient.

Many parties assume personal items (TV mounts, curtains, smart devices, appliances, or fixtures) are automatically excluded, but the form treats many attached items as part of the Property unless excluded. If exclusions are blank or vague, disputes arise at final walk-through and can trigger last-minute amendments or escrow holdbacks. Specifically list each excluded item (brand/location if helpful) and confirm removal timing before possession is delivered.

Buyers and agents frequently enter numbers in 3A and 3B that don’t add up to 3C, or they check/attach the wrong financing addendum (Third Party Financing vs. Assumption vs. Seller Financing). These inconsistencies confuse the lender and title company and can cause underwriting or closing disclosure rework. Double-check that 3C equals 3A + 3B and ensure the correct financing addendum boxes are checked and actually attached.

Paragraph 5A is often left partially blank (no escrow agent name/address) or the parties assume the title company automatically receives funds without confirming payee and delivery method. This can lead to late delivery, loss of option rights, or seller termination rights if deadlines are missed. Fill in the escrow agent and address precisely, confirm acceptable payment forms (wire/check), and calendar the 3-day delivery deadline from the Effective Date.

People commonly forget to fill in the number of Option Period days in Paragraph 5B, miscount days from the Effective Date, or miss the strict 5:00 p.m. local-time notice deadline. The consequence is losing the unrestricted right to terminate and potentially risking earnest money if termination is attempted late. Enter a specific number of days, calculate the exact end date/time immediately after the Effective Date is set, and send termination notices in the method allowed by Paragraph 21 with proof.

In Paragraph 6C, parties sometimes check more than one survey option, leave the day blanks empty, or fail to specify who pays if the existing survey/T-47 is rejected. This creates confusion and can force a rushed, expensive survey right before closing, risking delays. Check only one box, fill in the required number of days, and clearly confirm who pays for a new survey under each scenario described.

The HOA membership line in 6E(2) is frequently left blank, or parties mark “not subject” even when the property is in a mandatory HOA. Incorrect HOA handling can delay resale certificate delivery, create unexpected fees at closing, or expose the buyer to restrictions they didn’t plan for. Verify HOA status early (listing, seller, title search), check the correct box, and attach the HOA addendum when mandatory membership applies.

In Paragraph 7B, parties often check the wrong box (e.g., “Buyer has received” when it hasn’t been delivered) or leave the delivery-days blank when the notice is pending. This can unintentionally give the buyer extended termination rights up to closing or create disputes about whether termination was valid. Confirm actual receipt before checking 7B(1), otherwise use 7B(2) and fill in a specific delivery deadline and track the delivery date.

Paragraph 7D(2) warns against general phrases, yet people still write “subject to inspection,” “repairs as needed,” or “fix all lender items,” which is unenforceable and invites conflict. Vague terms lead to disagreements over scope, quality, and timing, often resulting in amendments or termination. List specific repairs/treatments with clear scope (what, where, standard), and handle inspection-based negotiations via a written amendment during the option period.

In Paragraph 10A, parties sometimes fail to check whether possession is upon closing/funding or pursuant to a temporary lease, or they allow early/late possession without attaching the appropriate TREC temporary lease. This can create an unintended tenancy at sufferance, insurance gaps, and liability disputes if damage occurs. Always select the correct possession option and attach a Buyer’s or Seller’s Temporary Residential Lease whenever possession timing differs from closing and funding.

Paragraph 21 is often incomplete (missing emails, fax numbers, or addresses), or the parties use an agent’s contact info without ensuring it’s valid for formal notice delivery. If a termination, objection, or demand notice is sent to the wrong place, it may be ineffective and deadlines can be missed. Enter reliable delivery addresses/emails for each party, confirm the preferred electronic transmission method, and keep proof of sending/receipt for time-sensitive notices.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out TREC 20-18 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills texas-real-estate-commission-trec-one-to-four-fami forms, ensuring each field is accurate.