Fill out due diligence forms

with AI.

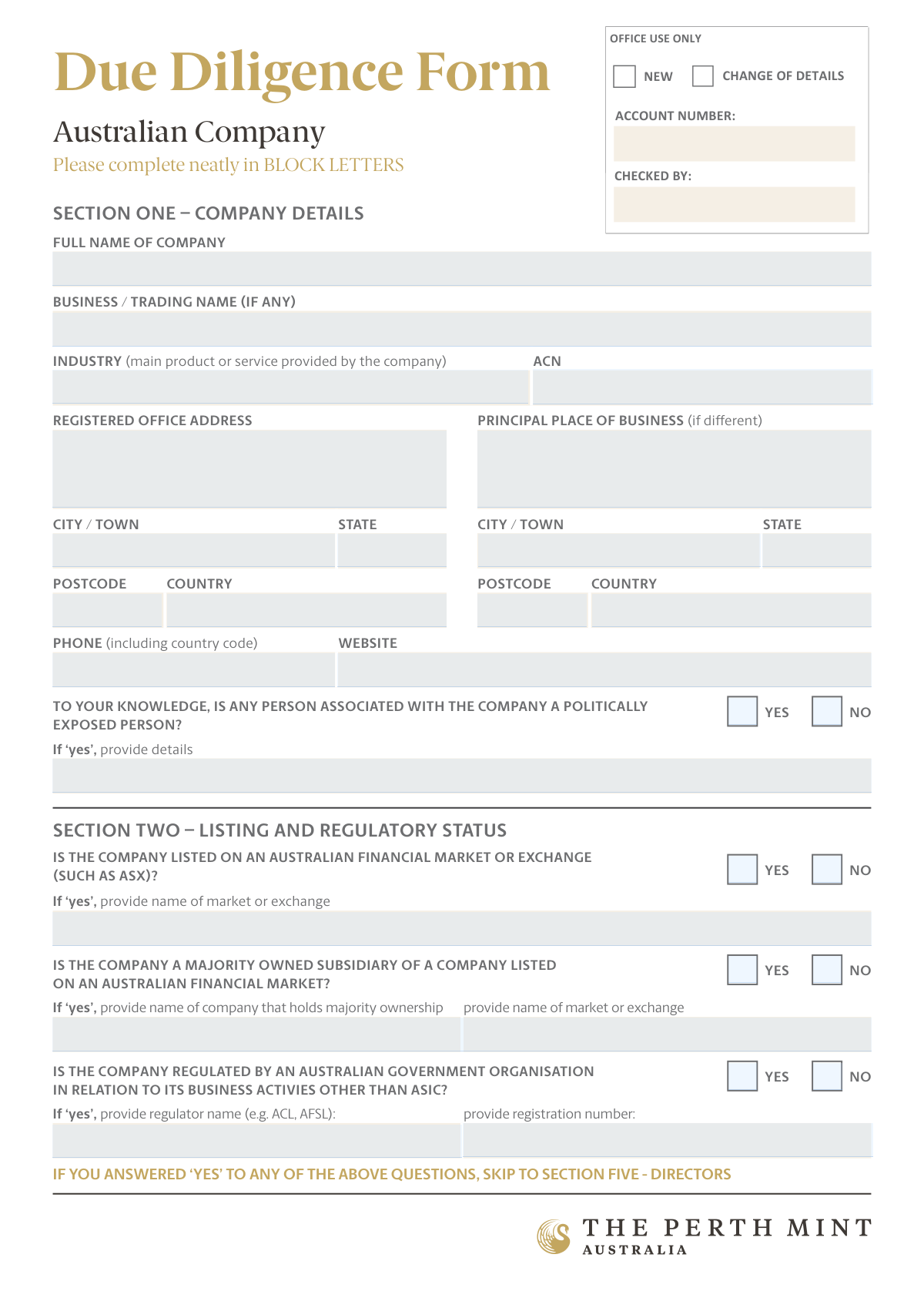

Due diligence forms are a critical component of corporate transparency and risk management, particularly within the Australian regulatory landscape. These documents are designed to verify the identity, ownership structure, and legal standing of a business entity before entering into a commercial agreement or financial arrangement. By systematically collecting data on directors, shareholders, and beneficial owners, compliance forms help organizations satisfy their Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) obligations, ensuring that all parties are operating within the bounds of the law.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About due diligence forms

Typically, these Australian business forms are required by legal teams, compliance officers, and business owners during the onboarding process for high-value services, such as bullion trading or institutional banking. For instance, when an Australian company opens a specialized account, they must provide exhaustive details regarding their regulatory status and any potential involvement with politically exposed persons (PEPs). Completing these forms accurately is essential to prevent delays in account validation and to maintain a clear audit trail for regulatory authorities.

Managing this level of administrative detail can be a significant burden for busy professionals. Tools like Instafill.ai use AI to fill these forms in under 30 seconds, handling sensitive corporate data accurately and securely. This streamlined approach allows businesses to focus on their core operations while ensuring their due diligence requirements are met with precision and speed.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Navigating Australian compliance requirements is a critical step for any business engaging in high-value financial activities. This category provides the necessary documentation to satisfy rigorous identity verification and regulatory standards.

Establishing Corporate Identity for Bullion Trading

If your organization is an Australian-registered company intending to open an account or conduct business with The Perth Mint, the primary document you require is the Due Diligence Form (Australian Company) – The Perth Mint. This form serves as a comprehensive Know Your Customer (KYC) tool, ensuring that both the entity and its representatives are properly vetted under Australian law.

Key Use Cases for This Form

Select the Due Diligence Form (Australian Company) – The Perth Mint if your current business objectives include:

- Regulatory Compliance: Meeting anti-money laundering (AML) and counter-terrorism financing (CTF) obligations.

- Ownership Transparency: Formally documenting beneficial owners, including any shareholders or individuals with significant control over the company.

- Management Verification: Providing a clear record of directors and key decision-makers within the corporate structure.

- Risk Assessment: Completing mandatory declarations regarding Politically Exposed Persons (PEPs) to mitigate financial risk.

Tips for a Seamless Process

Because this form requires detailed information and supporting certified identification, accuracy is paramount. Errors in beneficial ownership details or missing director information can lead to significant delays in account validation. By using Instafill.ai to process the Due Diligence Form (Australian Company) – The Perth Mint, you can streamline the data entry process, ensuring that all fields—from business registration numbers to PEP declarations—are completed accurately and professionally before submission.

Form Comparison

| Form | Purpose | Key Requirements | Target Audience |

|---|---|---|---|

| Due Diligence Form (Australian Company) – The Perth Mint | Verifies company identity and regulatory compliance for bullion transaction account setup. | Requires beneficial ownership details, PEP declarations, and certified identity verification documents. | Australian registered companies opening a trading account with The Perth Mint. |

Tips for due diligence forms

Before filling out the form, ensure the company name, ABN, and registered office address exactly match your latest ASIC current company extract. Small discrepancies between your form and government records are a common cause of delays in the verification process.

Identify all individuals who own 25% or more of the company or exert significant control before you start. Having their full legal names, dates of birth, and residential addresses ready will help you navigate the 'Beneficial Ownership' section without interruption.

Due diligence forms for Australian entities typically require certified copies of IDs for directors and major shareholders. Ensure these are signed by an authorized person, such as a Justice of the Peace or a police officer, to meet the strict verification standards of financial institutions.

Be precise when declaring whether any key decision-makers or shareholders are Politically Exposed Persons. Misunderstanding the definition or failing to disclose this status can lead to compliance flags that complicate your business relationship with the institution.

AI-powered tools like Instafill.ai can complete these complex due diligence forms in under 30 seconds with high accuracy. Your sensitive corporate data stays secure during the process, providing a reliable and time-saving solution for managing repetitive KYC documentation.

Many compliance documents are provided as non-fillable PDFs that require printing and scanning. Use a tool to convert these into interactive forms to avoid handwriting errors and ensure all fields are legible for the compliance officer reviewing your application.

If you are submitting forms for several related Australian companies, ensure the organizational structure and ownership details are consistent across all documents. Compliance teams often cross-reference these forms, and inconsistent data may trigger an audit or request for further clarification.

Frequently Asked Questions

These forms are used to verify the identity and legitimacy of a business entity before entering into a commercial relationship. They help organizations like The Perth Mint comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations by confirming who truly owns and controls the company.

Any Australian company looking to open an account for high-value transactions, such as bullion trading, must complete these forms. This includes private companies, public companies, and corporate trustees who need to provide details about their directors and significant shareholders.

You will generally need to provide the company's legal name, Australian Business Number (ABN) or Australian Company Number (ACN), and registered office address. Additionally, the form requires information on beneficial owners, directors, and any individuals with significant control over the entity.

Financial institutions are required to identify if a company's directors or owners hold prominent public positions or have close associations with such individuals. This is a standard regulatory requirement to assess potential risks associated with bribery or corruption in international and domestic transactions.

Most due diligence processes require certified copies of identification for directors and beneficial owners, such as passports or driver’s licenses. You may also need to provide company registration certificates or trust deeds to verify the structure and legal standing of the business.

A beneficial owner is typically any individual who owns or controls 25% or more of the company, either directly or indirectly. If no one meets this threshold, the form may require details for the individuals who exercise the most significant management control over the business.

Yes, AI tools like Instafill.ai can process these complex compliance forms in under 30 seconds. The AI accurately extracts data from your source documents and places it directly into the required fields, reducing the risk of manual entry errors.

While manual completion can take significant time due to the detailed information required, using an AI-powered service can finish the task almost instantly. These tools can also convert static PDF forms into interactive ones, making the submission process much faster for Australian businesses.

Once the form is filled and signed, it is usually submitted directly to the compliance department of the institution you are dealing with, such as The Perth Mint. Ensure all required certified attachments are included to avoid delays in the account validation process.

Incomplete forms often lead to significant delays in account approval or the rejection of the application. Accuracy is critical in due diligence to ensure the institution can satisfy its legal obligations regarding identity verification and risk assessment.

While primarily used for onboarding new clients, due diligence forms may also be required periodically for existing accounts. This ongoing due diligence ensures that the information held by the institution remains current and reflects any changes in company structure or ownership.

Glossary

- KYC (Know Your Customer)

- A mandatory process used by financial institutions and businesses to verify the identity of their clients to prevent identity theft, fraud, and money laundering.

- Beneficial Owner

- An individual who ultimately owns or controls a company, usually defined as someone holding 25% or more of the shares or voting rights, even if the shares are held in another name.

- AML/CTF

- Short for Anti-Money Laundering and Counter-Terrorism Financing, these are the legal frameworks and regulations that require businesses to report and prevent suspicious financial activities.

- PEP (Politically Exposed Person)

- An individual who holds, or has held, a prominent public position (such as a politician or senior executive of a state-owned body) and may be at higher risk for potential involvement in bribery or corruption.

- Certified Copy

- A photocopy of an original document that has been verified and signed by an authorized person, such as a Justice of the Peace or lawyer, to confirm it is a true copy.

- ASIC (Australian Securities and Investments Commission)

- The Australian government body that regulates companies, financial markets, and financial services to ensure they operate fairly and transparently.

- Ultimate Holding Company

- The parent company at the top of a corporate structure that has final control over a subsidiary and is not itself a subsidiary of any other corporation.

- Verification of Identity (VOI)

- The formal process of checking a person's identity documents to ensure they are who they claim to be before entering into a legal or financial agreement.