Form 2106, Employee Business Expenses Completed Form Examples and Samples

Explore an example of a completed IRS Form 2106 tailored for a sales representative. This guide provides insights on reporting unreimbursed expenses like mileage, travel, lodging, and meals for the 2024 tax year. A comprehensive resource for maximizing allowable deductions and ensuring accurate form completion.

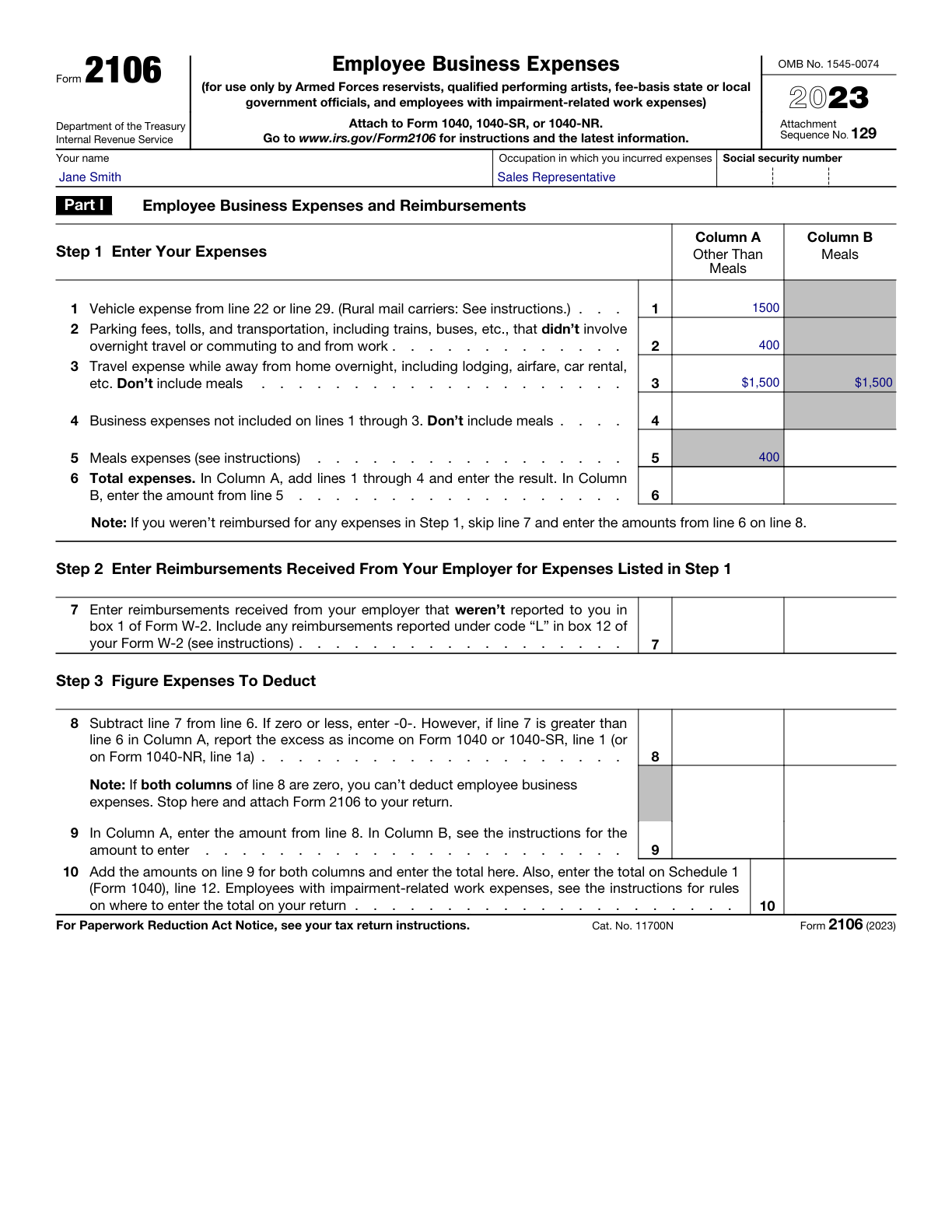

Form 2106 Example – Sales Representative

How this form was filled:

This example demonstrates how a sales representative fills out Form 2106 to claim unreimbursed travel, meal, and vehicle expenses. The form includes detailed computation for mileage, lodging, and meal costs associated with business trips in 2024.

Information used to fill out the document:

- Employee’s Name: Jane Smith

- Occupation: Sales Representative

- Employer's Name: ABC Sales Corp

- Travel Expenses: $1,500

- Vehicle Mileage: 3,000 miles

- Vehicle Expenses: $0.58 per mile

- Meal Expenses: $400

- Date: 2024

What this filled form sample shows:

- Detailed calculation of business mileage and vehicle expense deduction

- Inclusion of hotel and lodging costs under travel expenses

- Accurate entry of meal expenses with applicable deductions

- Guidance on claiming unreimbursed employee expenses

Form specifications and details:

| Use Case: | Sales representative claiming unreimbursed business expenses for travel and meals |

| Tax Year: | 2024 |

| Applicable Expenses: | Travel, lodging, meals, mileage |