Form FTB 3514, California Earned Income Tax Credit Completed Form Examples and Samples

Explore comprehensive examples of the FTB 3514 form, illustrating how to accurately complete the California Earned Income Tax Credit application. These samples demonstrate detailed steps for various scenarios, aiding low-income individuals and families in navigating tax compliance effectively.

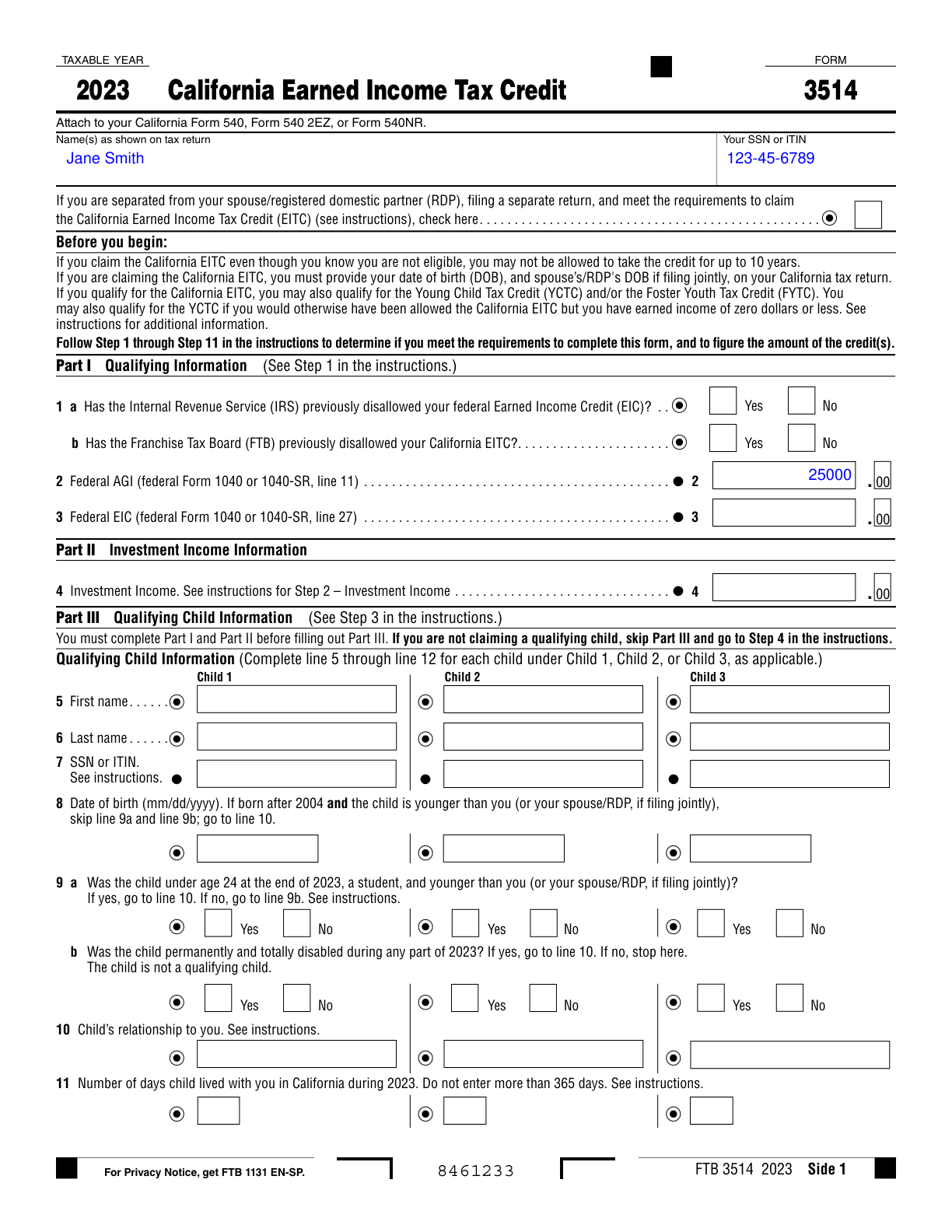

FTB 3514 Example – California Earned Income Tax Credit

How this form was filled:

This example illustrates a properly completed FTB 3514 form for claiming the California Earned Income Tax Credit (EITC). Key fields include the claimant's personal and income details, accurately calculated credit amount, and signature.

Information used to fill out the document:

- Taxpayer's Name: Jane Smith

- SSN: 123-45-6789

- Filing Status: Head of Household

- Number of Qualifying Children: 2

- Total Earned Income: $25,000

- Adjusted Gross Income: $25,000

- Calculated EITC: $1,500

- Address: 456 Elm Street, Los Angeles, CA 90001

- Signature: Jane Smith

- Date: 03/15/2025

What this filled form sample shows:

- Correctly filled personal information and SSN

- Specified filing status and number of qualifying children

- Accurate earned income details for EITC calculation

- Properly calculated California EITC amount

- Duly completed signature and date

Form specifications and details:

| Use Case: | Low-income individual or family filing for CA EITC |

| Tax Year: | 2024 |

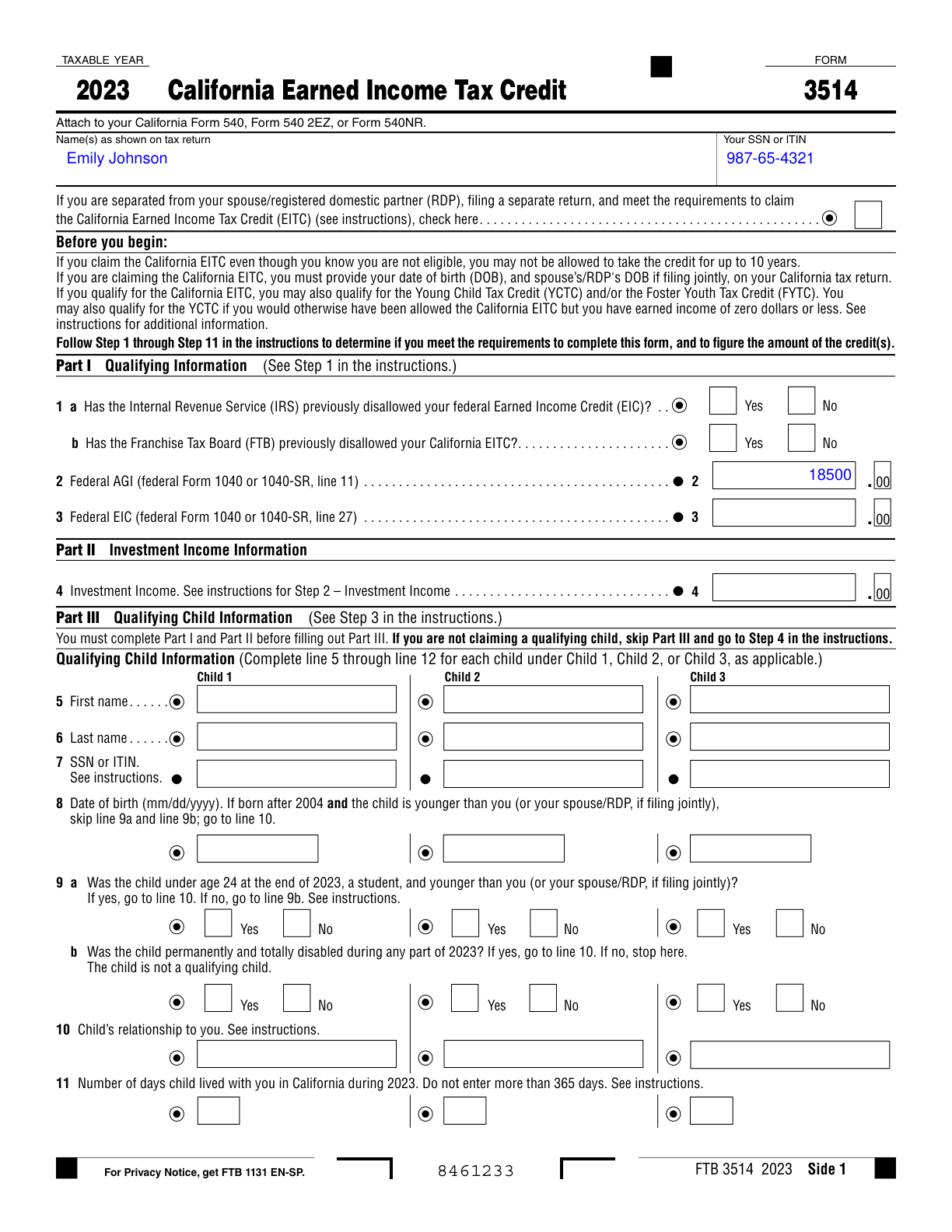

FTB 3514 Example – California EITC for Single Parent with One Child

How this form was filled:

This example demonstrates a filled FTB 3514 form for a single parent with one child claiming the California Earned Income Tax Credit. Important fields include the parent's personal details, income specifics, qualifying child information, and the correctly computed credit.

Information used to fill out the document:

- Taxpayer's Name: Emily Johnson

- SSN: 987-65-4321

- Filing Status: Single

- Number of Qualifying Children: 1

- Total Earned Income: $18,500

- Adjusted Gross Income: $18,500

- Calculated EITC: $750

- Address: 789 Maple Avenue, San Diego, CA 92103

- Signature: Emily Johnson

- Date: 03/10/2025

What this filled form sample shows:

- Accurately completed personal information and SSN

- Specified filing status as single with one qualifying child

- Correct earned income details for EITC calculation

- Precise computation of California EITC amount

- Signed and dated signature section

Form specifications and details:

| Use Case: | Single parent with one child claiming CA EITC |

| Tax Year: | 2025 |