Form 4137, Social Security and Medicare Tax on Unreported Tip Income Completed Form Examples and Samples

Discover a comprehensive example of Form 4137 for reporting unreported tip income. This guide includes detailed tax calculations and employee information, providing a useful reference for completing your own form.

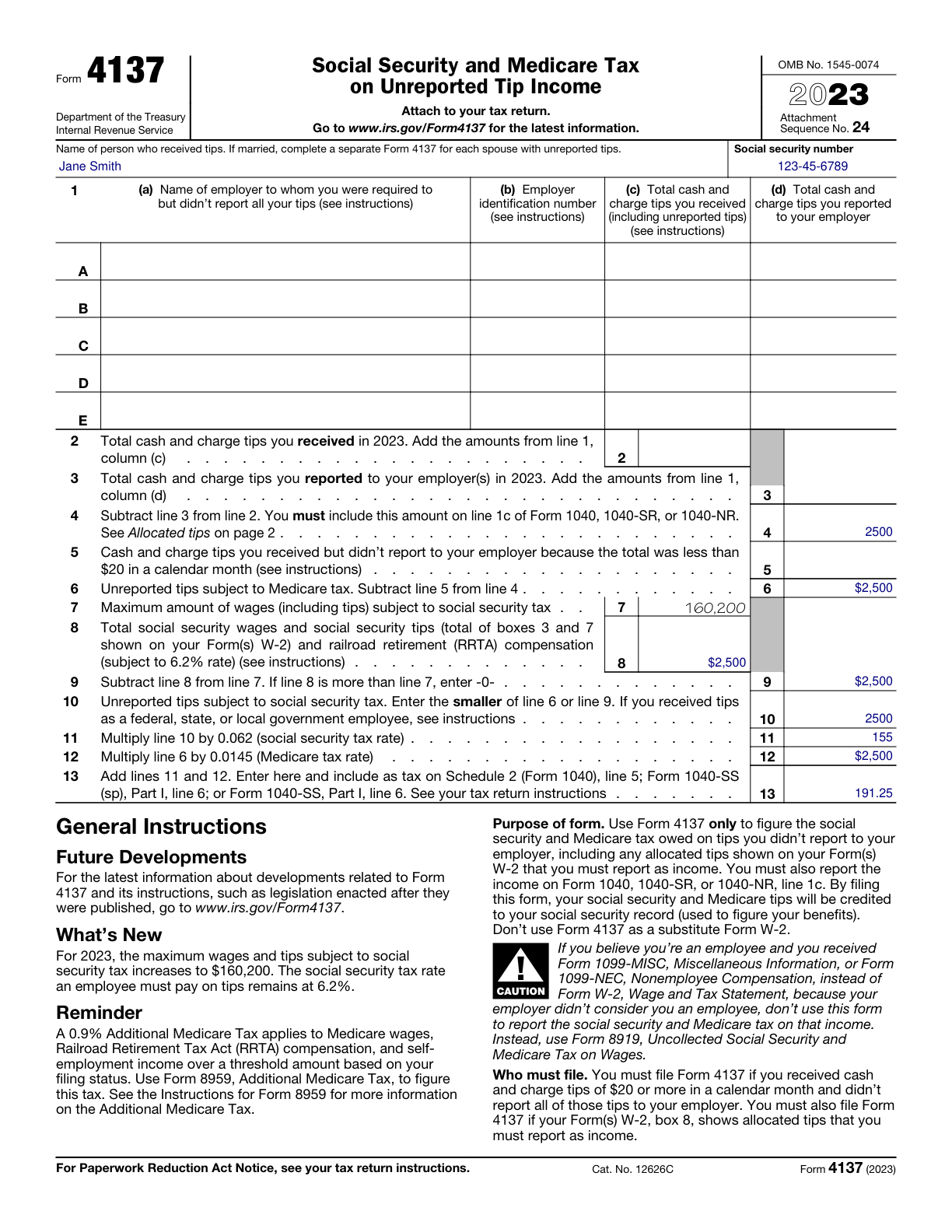

Form 4137 Example – Unreported Tip Income

How this form was filled:

This example shows how to fill out Form 4137 for reporting unreported tip income. The form includes details such as the employee's name, SSN, total tips received, and calculations of Social Security and Medicare tax.

Information used to fill out the document:

- Employee’s Name: Jane Smith

- Social Security Number (SSN): 123-45-6789

- Total Tips Received: $4,500

- Reported Tips: $2,000

- Unreported Tips: $2,500

- Social Security Tax Calculation: $155

- Medicare Tax Calculation: $36.25

- Year: 2025

What this filled form sample shows:

- Accurate entry of employee information including name and SSN

- Step-by-step calculation of unreported tip income

- Detailed breakdown of Social Security and Medicare tax amounts

- Correct classification of reported and unreported tips

Form specifications and details:

| Use Case: | Unreported Tip Income |

| Filing Year: | 2025 |