Form APL-505, Taxpayer’s Earned Income Tax Credit Protest Completed Form Examples and Samples

View filled-out examples of Form APL-505, Taxpayer’s Earned Income Tax Credit Protest. Our detailed samples show how to correctly complete the form to appeal an EITC denial, helping you understand what information to provide. Get clear guidance from our APL-505 examples.

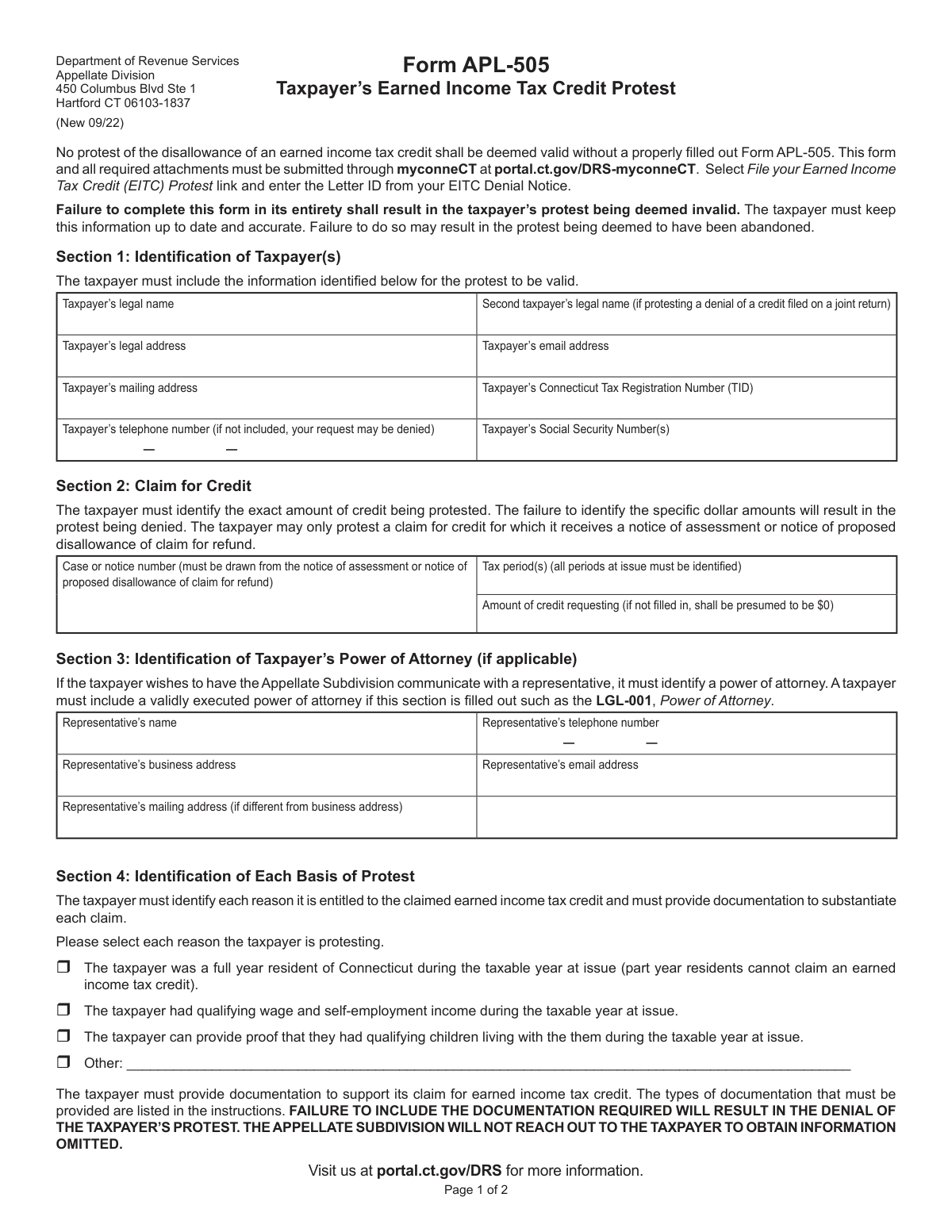

Form APL-505 Example: EITC Protest for Qualifying Child Residency

How this form was filled:

This sample of Form APL-505 shows a taxpayer, Jane Smith, protesting the denial of her 2025 Earned Income Tax Credit. The form clearly states the tax year, case reference number, and the specific reason for the protest: the IRS incorrectly determined that her qualifying child, Emily, did not meet the residency test. The taxpayer asserts the child lived with her for the entire year and lists supporting documents like school and medical records that will be sent with the form.

Information used to fill out the document:

- Taxpayer's Name: Jane Smith

- Taxpayer's SSN: XXX-XX-1234

- Address: 456 Oak Avenue, Anytown, CA 90210

- Daytime Phone Number: (555) 123-4567

- Tax Year: 2025

- Case Reference Number: 1234567890

- Qualifying Child's Name: Emily Smith

- Reason for Protest: I disagree with the finding that my qualifying child, Emily Smith, did not live with me for more than half the year. My child lived with me at the address listed for the entire 2025 tax year. I am providing documents to prove residency.

- Supporting Documents Mentioned: School records showing my home address, medical records, and a copy of my lease agreement.

- Signature: Jane Smith

- Date: 02/15/2026

What this filled form sample shows:

- Clear identification of the tax year and case reference number from the IRS notice.

- A specific and concise reason for the protest that directly addresses the reason for the EITC denial.

- A list of relevant supporting documents that will be provided to substantiate the taxpayer's claim.

- Correctly filled personal information and a properly dated signature.

Form specifications and details:

| Form Name: | Form APL-505, Taxpayer’s Earned Income Tax Credit Protest |

| Use Case: | Protesting EITC denial based on the qualifying child residency test. |

Created: February 14, 2026 06:34 AM