Yes! You can use AI to fill out Prudential Group Disability Insurance – Education and Employment History Form (GL.2009.009, Ed. 06/2017)

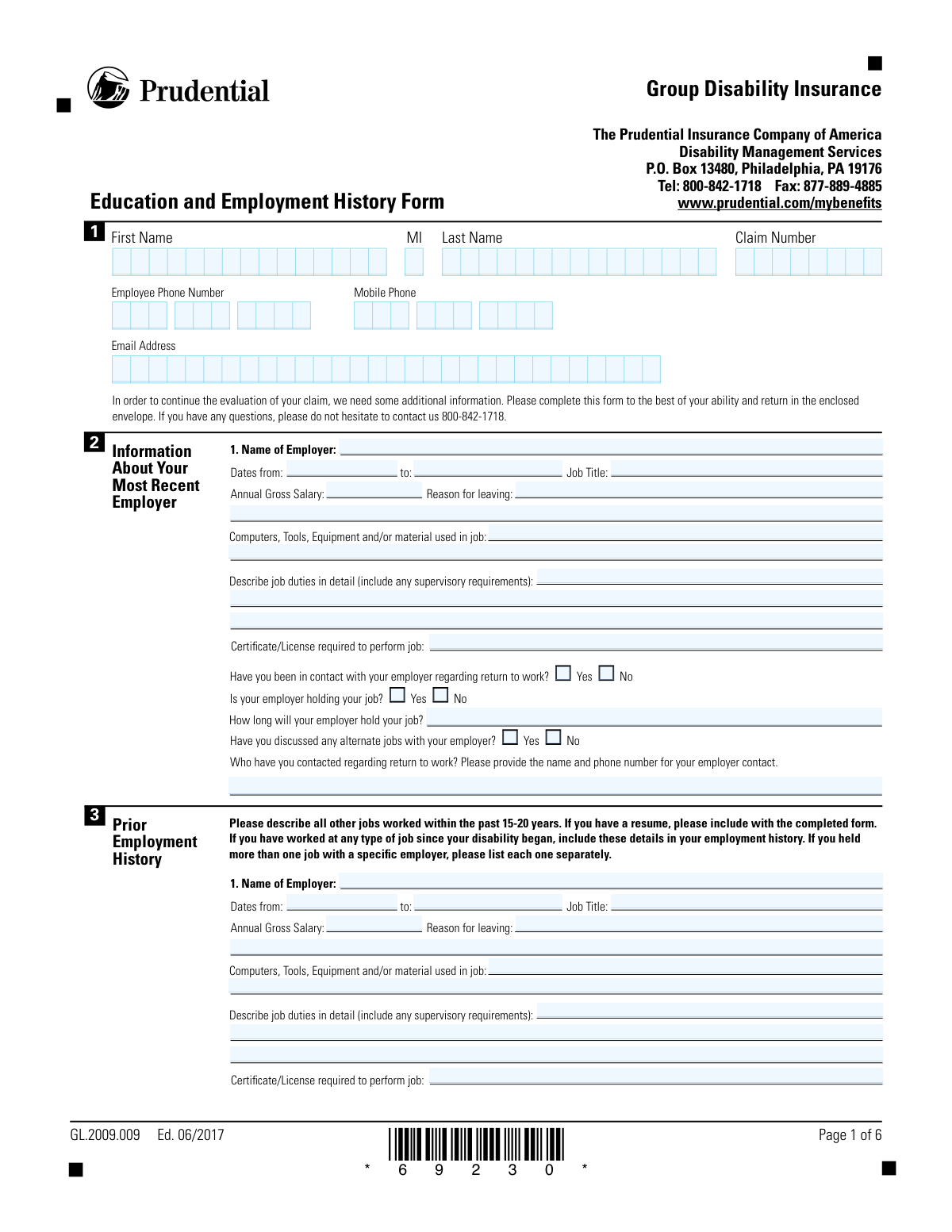

The Prudential Education and Employment History Form (GL.2009.009) is a claimant questionnaire used in Group Disability Insurance to gather detailed information about your most recent employer, prior jobs over the past 15–20 years, and your education, training, and skills. Prudential uses this information to continue evaluating your disability claim, understand your occupational background and functional job requirements, and assess vocational/return-to-work options. The form also includes a fraud notice and requires your certification and signature, making accuracy and completeness important to avoid delays or adverse claim decisions.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out GL.2009.009 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Prudential Group Disability Insurance – Education and Employment History Form (GL.2009.009, Ed. 06/2017) |

| Number of pages: | 6 |

| Filled form examples: | Form GL.2009.009 Examples |

| Language: | English |

| Categories: | insurance forms, disability forms, employment forms, education forms, Prudential forms, disability insurance forms, Prudential insurance forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out GL.2009.009 Online for Free in 2026

Are you looking to fill out a GL.2009.009 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your GL.2009.009 form in just 37 seconds or less.

Follow these steps to fill out your GL.2009.009 form online using Instafill.ai:

- 1 Enter claimant identification details (first name, last name, middle initial, claim number, email address, and phone numbers) as shown on your Prudential claim materials.

- 2 Complete the “Most Recent Employer” section: provide employer name, job title, dates worked, annual gross salary, reason for leaving, tools/equipment used, detailed job duties (including supervisory duties), and whether you have discussed return-to-work or alternate jobs with the employer.

- 3 Fill out the “Prior Employment History” for all other jobs in the past 15–20 years (list each job separately, even with the same employer): employer name, dates, job title, salary, reason for leaving, duties, tools/equipment, and any required certificates/licenses; attach a resume and add pages if needed.

- 4 Provide your “Education/Training” information: highest grade completed, high school/GED details, college and vocational training, military training, areas of concentration, degrees, and any certificates/licenses (including expiration dates and how you keep them active).

- 5 Complete the “Computer Skills” section: indicate device/internet access, typing ability and speed, programs used (e.g., Word/Excel/PowerPoint/email/databases), proprietary software, social media use, IT certifications, and how you use technology at work and at home.

- 6 If applicable, complete the “Recent/Current Job-Seeking” section: length of job search, responses received, resources used (e.g., state employment service, vocational rehabilitation, friends, want ads), positions sought, and whether you want assistance locating suitable employment.

- 7 Read the fraud notice, certify the statements are true, then sign and date the form; submit it to Prudential using the provided return method (e.g., enclosed envelope or as instructed by your claim representative).

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable GL.2009.009 Form?

Speed

Complete your GL.2009.009 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 GL.2009.009 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form GL.2009.009

Prudential uses this form to gather details about your education, work history, and job skills so they can continue evaluating your group disability claim and your ability to work (including possible return-to-work options).

The claimant (the person applying for or receiving disability benefits) should complete this form. If you need help filling it out, you can have someone assist you, but you must sign and date it yourself.

List all jobs you worked within the past 15–20 years. If you have worked at any job since your disability began, include those jobs as well.

List each job title/position separately, even if it was with the same employer. This helps Prudential understand changes in duties, pay, and physical/skill requirements over time.

Provide your job title, dates worked, annual gross salary, reason for leaving, tools/equipment used, and a detailed description of your duties (including any supervisory responsibilities). You’ll also answer questions about return-to-work contact with your employer and whether your job is being held.

Describe what you did day-to-day, including key tasks, how often you performed them, and any supervisory duties. Include relevant physical or technical aspects (for example, lifting, standing, driving, computer work, or operating machinery).

Yes. For each job, list any certificate or license required to perform it, and in the education/training section include whether it has expired, the expiration date, and what you’ve done to keep it active.

You should still complete the form to the best of your ability, but you may include your resume with the completed form. A resume can help fill gaps and provide additional detail.

Add extra pages if you held more than the number of jobs listed on the form (it notes to add pages if more than 3 jobs in the past 20 years). Make sure each added page includes your name and claim number if possible.

They ask for your highest grade completed, high school/GED information, college training (degree/type, years completed, concentration), vocational training, military training, and any other training or special designations such as certificates or licenses.

Computer and technology skills can be relevant to evaluating what types of work you may be able to perform. The form asks about devices you use, typing/keyboard ability, programs used (e.g., Word/Excel), email, databases, social media, and any IT certifications.

Only complete the Recent/Current Job-Seeking section if you have been exploring returning to work in some capacity. If you have not been job searching, you can leave that section blank.

Return the completed form using the enclosed envelope (as instructed on the form). If you have questions, you can call Prudential Disability Management Services at 800-842-1718 or fax documents to 877-889-4885.

The fraud notice explains that providing false, incomplete, or misleading information may be a crime and can lead to penalties and denial of benefits. Your signature certifies that the information you provided is true and that you understand the fraud warnings.

Complete the form to the best of your ability and provide your best estimates if you don’t know exact figures. If you’re unsure, you can note that the information is approximate and attach a resume or additional explanation.

Compliance GL.2009.009

Validation Checks by Instafill.ai

1

Validates Claimant Identity Fields Are Present and Non-Placeholder

Checks that First Name, MI (if provided), Last Name, and Claim Number are completed and are not left blank or filled with non-data placeholders (e.g., repeated asterisks or form markers like “*69230*”). This is important to correctly associate the form with the right claimant and claim file. If validation fails, the submission should be rejected or routed to manual review because it cannot be reliably matched to a claim.

2

Validates Claim Number Format and Consistency Across Pages

Ensures the Claim Number follows the expected insurer format (e.g., allowed length/characters) and is consistent wherever it appears on the form (multiple pages show the field). This prevents misfiling and reduces downstream reconciliation errors. If the claim number is missing, malformed, or inconsistent, the system should flag the submission and require correction before processing.

3

Validates Email Address Format (If Provided)

Checks that the Email Address, when entered, matches a standard email pattern (local-part@domain) and does not contain spaces or invalid characters. Email is often used for follow-up and return-to-work coordination, so invalid addresses cause communication failures. If invalid, the system should prompt the claimant to correct it or allow submission only if email is optional and another contact method is valid.

4

Validates Phone Number Formats for Employee and Mobile Phones

Ensures Employee Phone Number and Mobile Phone (if provided) contain valid digits and formatting (e.g., 10-digit US numbers, optional country code, valid separators) and are not obviously incomplete (e.g., fewer than 10 digits). Accurate phone numbers are critical for claim evaluation and employer/claimant contact. If validation fails, the form should be flagged for correction or manual outreach.

5

Conditional Employer Contact Details Required When Return-to-Work Contact Is Indicated

If the claimant answers “Yes” to being in contact with the employer regarding return to work, the form must include the name and phone number of the employer contact in the “Who have you contacted…” field. This ensures the carrier can verify return-to-work discussions and coordinate accommodations. If “Yes” is selected but contact details are missing or invalid, the submission should be considered incomplete.

6

Validates Employer Holding Job Logic and Required Duration Field

If “Is your employer holding your job?” is answered “Yes,” then “How long will your employer hold your job?” must be completed with a valid duration (e.g., a number of weeks/months or a specific date, per system rules). This information affects return-to-work planning and benefit management. If the holding-job answer is “Yes” but the duration is blank or nonsensical, the system should require correction.

7

Validates Most Recent Employer Entry Completeness

For the “Most Recent Employer” section, verifies required fields are present: Employer Name, Job Title, Dates From/To, Annual Gross Salary, Reason for Leaving, and a meaningful description of job duties. These fields are essential for occupational analysis and disability determination. If any required element is missing, the form should be flagged as incomplete and returned for completion.

8

Validates Employment Date Ranges and Chronology

Checks that each employment “Dates from” and “to” is a valid date (or valid month/year if that is allowed) and that the start date is not after the end date. It also flags future dates and overlapping date ranges across jobs when overlaps are not explained (e.g., multiple concurrent jobs should be listed separately but still logically consistent). If invalid or inconsistent, the system should request clarification or route to manual review.

9

Validates Annual Gross Salary Is Numeric and Reasonable

Ensures Annual Gross Salary is provided as a numeric value (allowing currency symbols/commas) and is within reasonable bounds (e.g., not negative, not zero unless explained, not implausibly large). Salary is used for benefit calculations and vocational assessment. If salary is missing or fails numeric/range checks, the system should block submission or require correction depending on business rules.

10

Validates Prior Employment History Entries Are Structured and Complete Per Job

For each prior job listed (e.g., employers 2–5), validates that if any field in a job block is filled, then the minimum required set for that job is also completed (Employer Name, Job Title, Dates, Reason for Leaving, and duties). This prevents partial job records that cannot be used for vocational history analysis. If partial entries are detected, the system should prompt the claimant to complete or remove the incomplete job block.

11

Validates Certificate/License Requirement Fields and Expiration Logic

If a job indicates a certificate/license is required, the form should capture the certificate/license name and whether it has expired; if expired is “Yes,” an expiration date must be provided. This is important for assessing transferable skills and employability. If the claimant indicates expiration but provides no date (or an invalid date), the system should flag the record for correction.

12

Validates Education Section: Highest Grade, Graduation Date, and GED Conditional Fields

Checks that Highest grade completed is present and numeric/valid (e.g., 0–20 or per configured scale) and that Date of Graduation is a valid date when provided. If the claimant is not a high school graduate and answers “Yes” to obtaining a GED, then the GED date (“If so, when?”) must be completed. If these conditions are not met, the education history should be marked incomplete.

13

Validates Training Entries Have Required Subfields When Selected

For College Training, Vocational Training, and Military Services Training, ensures that when a training type is indicated/filled, the associated required subfields are present (e.g., degree/type, where, area of concentration, number of years completed, length of training, and when). This supports accurate assessment of qualifications and skill sets. If training is referenced but key details are missing, the system should request completion or clarification.

14

Validates Computer Skills Section Yes/No Dependencies

If the claimant answers “Yes” to owning/using a computer/smartphone/tablet, then the “what do you use it for” description should not be blank. If “Can you keyboard/type?” is “Yes” and words-per-minute is requested, the WPM field must be numeric and within a reasonable range. If dependencies are not satisfied, the system should flag the section as incomplete because it affects vocational and return-to-work evaluation.

15

Validates Job-Seeking Section Completeness When Indicated

Because the form states this section should be completed only if exploring return to work, the system should validate that if any job-seeking fields are filled (or if assistance is requested), then key fields are completed: duration of search, types of positions sought, responses received, and resources utilized. This ensures consistent interpretation of the claimant’s return-to-work efforts. If partially completed, the system should prompt for missing required details or allow the claimant to clear the section if not applicable.

16

Validates Fraud Notice Acknowledgment, Signature Presence, and Date Signed Format

Ensures the claimant certification is completed: signature is present (not just an “X” placeholder unless e-sign rules allow it) and Date Signed is provided in the required format (mm dd yyyy) and is not a future date. This is legally important for attestation and fraud warnings and may be required for claim handling. If missing/invalid, the submission should be rejected as not properly certified.

Common Mistakes in Completing GL.2009.009

People often skip the header fields (First Name, Last Name, MI, Claim Number) on each page or enter them differently across pages, especially when printing and completing by hand. This can cause pages to be separated from the file or misfiled, delaying claim evaluation. Always write your claim number and full legal name exactly as shown on Prudential correspondence on every page that requests it.

A common error is entering an outdated email, omitting an area code, or putting the same number in both “Employee Phone Number” and “Mobile Phone” without indicating which is best. If Prudential cannot reach you quickly, they may pause the review or send time-sensitive requests by mail. Double-check that your email is spelled correctly, include area codes, and specify the best number to reach you during business hours.

Claimants frequently overlook the checkboxes about contacting the employer, whether the job is being held, and whether alternate jobs were discussed. Missing or unclear answers can trigger follow-up calls and slow the return-to-work assessment. Select “Yes” or “No” for each item and add brief clarifying details when the situation is complicated (e.g., employer won’t confirm in writing).

When asked “Who have you contacted…name and phone number,” people often write only a company name or “HR” without a direct contact and phone. This prevents the disability case manager from verifying job-hold status or exploring accommodations, which can delay decisions. Provide a specific person (name, title/department if known) and a direct phone number (and extension) whenever possible.

Many entries show only years (e.g., “2019–2021”), leave the “to” date blank, or use inconsistent formats that are hard to interpret. Incomplete timelines create gaps in the 15–20 year work history and may require additional documentation. Use a clear month/day/year or at least month/year for both “Dates from” and “to,” and write “Present” if still employed (or the exact last day worked if not).

People often list only their most recent employer and forget part-time, temporary, seasonal, self-employment, or short-duration roles—especially work performed after disability began. Missing jobs can affect vocational evaluation and may raise questions about work capacity and earnings. Review the last 15–20 years carefully and include every job, including any work attempted after the disability onset, even if it was brief or unsuccessful.

The form instructs that if you held more than one job with a specific employer, each should be listed separately, but many people combine them into one entry. This can blur changes in duties, physical demands, and skill requirements that are important for disability and vocational review. Create separate lines/entries for each distinct job title with its own dates, duties, tools/software, and reason for leaving.

Common responses like “office work,” “managed team,” or “customer service” don’t explain the actual tasks, physical requirements, or supervisory responsibilities. Vague duties make it difficult to assess occupational demands and transferable skills, often leading to follow-up requests. Describe duties in concrete terms (e.g., lifting amounts, standing/walking time, typing volume, number of direct reports, equipment used, and typical daily tasks).

Claimants frequently skip “Annual Gross Salary,” enter net pay, or write “medical” without context in “Reason for leaving.” Incomplete compensation and separation details can complicate benefit calculations and employment verification. Enter annual gross (before taxes) as accurately as possible, note if it was hourly and approximate annualized earnings, and give a clear reason (e.g., “stopped working due to back injury on [date]” or “laid off due to reduction in force”).

People often leave blank the sections on computers/tools/materials used and certificates/licenses required, assuming they are not important. These details are central to evaluating transferable skills and whether a job required specialized credentials. List key equipment and software (including proprietary systems if you can name them) and include license/certification names, whether they are required, and expiration/renewal status.

A frequent mistake is checking boxes without providing dates, listing a school without the degree type (AAS/BA/etc.), or leaving “No. of years completed” blank when the program wasn’t finished. Missing education details can lead to an inaccurate vocational profile and additional requests for clarification. Provide the highest grade completed, graduation date (or “did not graduate”), GED status and date if applicable, and complete degree/certificate fields even if partially completed.

Some claimants forget to sign, forget to date, or use an unclear date format even though the form requests “Date Signed (mm dd yyyy).” An unsigned/undated form may be treated as incomplete and can delay claim processing. Sign exactly where indicated and write the date in the requested format (e.g., 02 03 2026) to avoid rework.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out GL.2009.009 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills prudential-group-disability-insurance-education-an forms, ensuring each field is accurate.