Yes! You can use AI to fill out State of Florida Department of Highway Safety and Motor Vehicles (FLHSMV) Form HSMV 82993, Separate Odometer Disclosure Statement and Acknowledgment

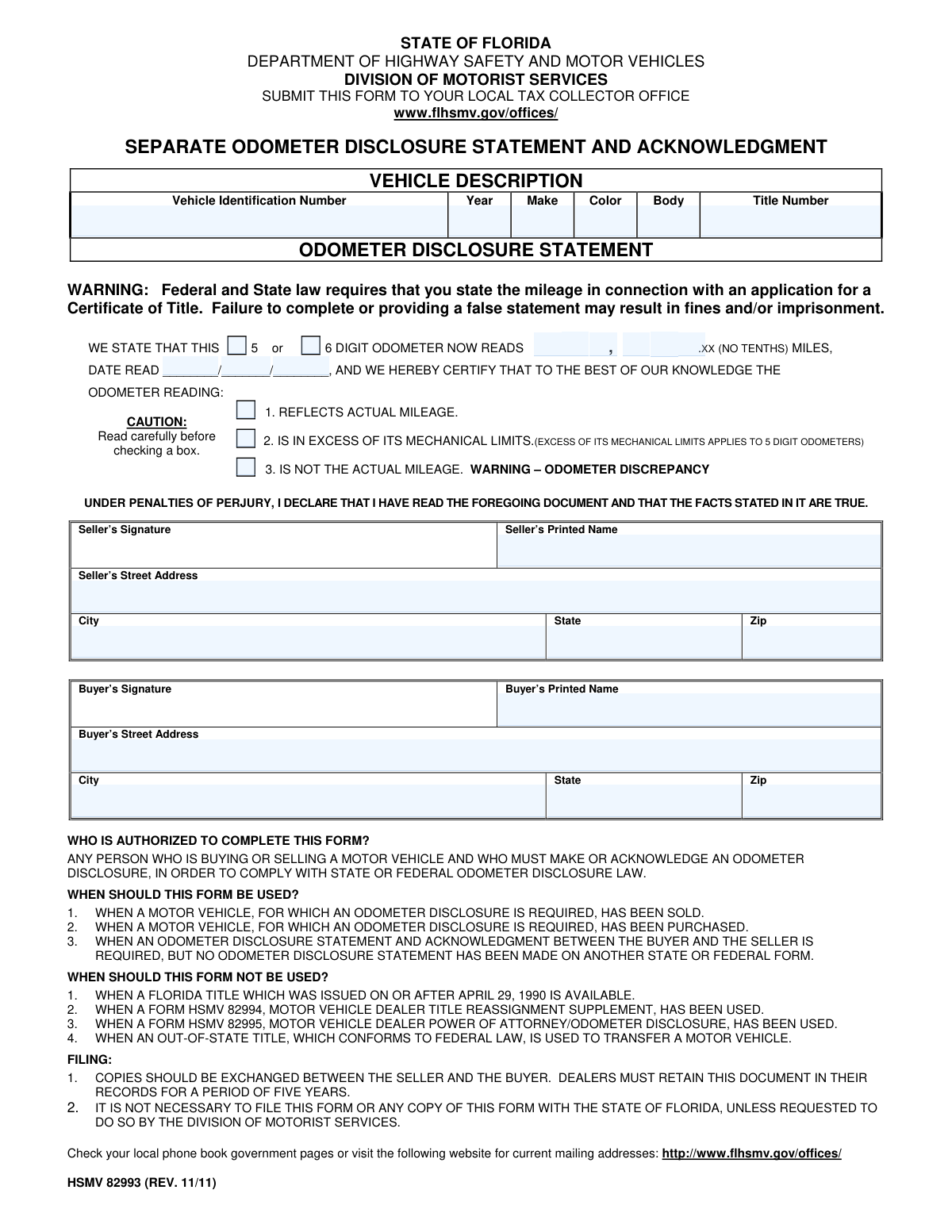

Form HSMV 82993 is a Florida “Separate Odometer Disclosure Statement and Acknowledgment” used during a motor vehicle sale or purchase to document the odometer reading and certify whether it reflects actual mileage, exceeds mechanical limits, or is not the actual mileage. Federal and state law require this mileage disclosure in connection with an application for a Certificate of Title, and false statements can lead to fines or imprisonment. The form captures vehicle identification details and requires both seller and buyer signatures under penalties of perjury. It is typically used only when an odometer disclosure is required but has not been made on another state or federal form (and not when a qualifying Florida title or certain dealer forms are used).

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out HSMV 82993 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | State of Florida Department of Highway Safety and Motor Vehicles (FLHSMV) Form HSMV 82993, Separate Odometer Disclosure Statement and Acknowledgment |

| Number of pages: | 1 |

| Filled form examples: | Form HSMV 82993 Examples |

| Language: | English |

| Categories: | disclosure forms, AFE forms, FLHSMV forms, Florida DMV forms, vehicle title forms, odometer disclosure forms, Florida vehicle forms, PA state forms |

Instafill Demo: filling out a legal form in seconds

How to Fill Out HSMV 82993 Online for Free in 2026

Are you looking to fill out a HSMV 82993 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2026, allowing you to complete your HSMV 82993 form in just 37 seconds or less.

Follow these steps to fill out your HSMV 82993 form online using Instafill.ai:

- 1 Enter the vehicle description details: Vehicle Identification Number (VIN), year, make, color, body type, and title number (if available).

- 2 Record the odometer reading exactly as shown (no tenths) and indicate whether it is a 5-digit or 6-digit odometer, then enter the date the mileage was read.

- 3 Select the appropriate odometer certification box: (1) reflects actual mileage, (2) in excess of mechanical limits (for 5-digit odometers), or (3) not the actual mileage (odometer discrepancy).

- 4 Complete the seller section: seller’s printed name, signature, street address, city, state, and ZIP code.

- 5 Complete the buyer section: buyer’s printed name, signature, street address, city, state, and ZIP code.

- 6 Review the perjury statement and confirm all entries are accurate and legible before finalizing the document.

- 7 Provide copies to both buyer and seller (and retain records if a dealer); submit to the local tax collector office only if instructed/required for the title transaction or requested by the Division of Motorist Services.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable HSMV 82993 Form?

Speed

Complete your HSMV 82993 in as little as 37 seconds.

Up-to-Date

Always use the latest 2026 HSMV 82993 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form HSMV 82993

This form documents the vehicle’s odometer reading at the time of sale to comply with state and federal odometer disclosure laws. It helps ensure the mileage reported on a title application is accurate and properly acknowledged by both buyer and seller.

Any person buying or selling a motor vehicle who must make or acknowledge an odometer disclosure to comply with state or federal law may complete it. Both the seller and the buyer are expected to sign.

Use it when a vehicle requiring an odometer disclosure has been sold or purchased and no odometer disclosure was made on another state or federal form. It is also used when a separate buyer/seller odometer statement is required for the transaction.

Do not use it if you have a Florida title issued on or after April 29, 1990 available for the transfer, or if forms HSMV 82994 or HSMV 82995 were used. Also do not use it when an out-of-state title that conforms to federal law is being used to transfer the vehicle.

Generally, no—this form does not need to be filed with the State of Florida unless the Division of Motorist Services specifically requests it. The form instructs that copies should be exchanged between buyer and seller.

The heading provides a general direction for where vehicle paperwork is handled locally, but the “Filing” section clarifies that this specific form is not required to be filed unless requested. If you are unsure for your situation, contact your local tax collector office for guidance.

You should provide the Vehicle Identification Number (VIN), year, make, color, body type, and title number (if available). Enter the information exactly as it appears on the title or vehicle documents.

Write the mileage as a whole number only—do not include tenths of a mile. The “.XX” indicates that decimal places are not to be recorded.

Check “Reflects actual mileage” if the odometer reading is accurate to the best of your knowledge. Check “In excess of its mechanical limits” if a 5-digit odometer has rolled over, and check “Not the actual mileage” if you know or suspect the reading is incorrect (odometer discrepancy).

A 5-digit odometer can roll over after 99,999 miles, which is why the “mechanical limits” option applies to 5-digit odometers. A 6-digit odometer has a higher maximum before rollover, so that specific rollover warning is aimed at 5-digit units.

Both the seller and the buyer must sign and print their names. Each must also provide their street address, city, state, and ZIP code.

Enter the date the odometer reading was observed and recorded for the transaction. This is typically the date of sale or the date the parties completed the disclosure.

Yes. Dealers must retain this document in their records for five years, even though it generally is not filed with the state.

The form warns that federal and state law require a mileage statement for a title application, and failing to complete it or providing a false statement may result in fines and/or imprisonment. Complete the form carefully and truthfully.

You can find office locations at www.flhsmv.gov/offices/. The form also notes you can check government listings in your local phone book or use the FLHSMV website for current mailing addresses.

Compliance HSMV 82993

Validation Checks by Instafill.ai

1

Validates Vehicle Identification Number (VIN) format and check digit

Checks that the VIN is exactly 17 characters, uses only valid VIN characters (no I, O, or Q), and passes the ISO 3779 check-digit validation. This is critical because the VIN uniquely identifies the vehicle and is used to match title/registration records. If validation fails, the submission should be rejected or flagged for manual review because an incorrect VIN can invalidate the odometer disclosure and title transaction.

2

Ensures required vehicle description fields are present (Year, Make, Color, Body, Title Number)

Verifies that all vehicle description fields shown on the form are completed and not left blank. These fields help confirm the vehicle identity beyond the VIN and reduce the risk of mismatching the disclosure to the wrong vehicle. If any required field is missing, the form should be considered incomplete and returned for correction.

3

Validates vehicle year is a plausible 4-digit year

Checks that the Year is a 4-digit number and falls within a reasonable range (e.g., 1900 through current year + 1) to account for model-year timing. This prevents data entry errors like transposed digits or two-digit years. If the year is outside the allowed range, the system should block submission or require confirmation with supporting documentation.

4

Validates Title Number format (if provided) and disallows invalid characters

Ensures the Title Number matches Florida title number formatting rules used by the system (length/character set) and does not contain illegal characters or whitespace-only values. Title numbers are used to link the disclosure to an existing title record when applicable. If the title number fails validation, the record should be flagged and the user prompted to re-enter it exactly as shown on the title.

5

Validates odometer reading is numeric, whole miles, and properly formatted

Checks that the odometer reading contains only digits and represents whole miles (no tenths), consistent with the form’s “.XX (NO TENTHS)” instruction. It should also enforce a maximum length consistent with the selected odometer type (5 or 6 digits) and prevent commas/decimals or other symbols. If invalid, the system should reject the entry because an improperly formatted reading can make the disclosure noncompliant.

6

Enforces 5-digit vs 6-digit odometer selection and consistency with entered mileage

Validates that exactly one odometer digit-length option (5-digit or 6-digit) is selected and that the entered mileage length is consistent with that selection. This matters because the “mechanical limits” certification applies specifically to 5-digit odometers and the digit length affects interpretation of rollover. If the selection is missing, multiple, or inconsistent with the mileage, the submission should be blocked until corrected.

7

Requires exactly one odometer status certification (Actual / Exceeds Mechanical Limits / Not Actual)

Ensures the user selects one—and only one—of the three odometer reading statements. This is essential because the disclosure must clearly indicate whether the mileage is actual, has rolled over (mechanical limits), or is otherwise not actual. If none or multiple are selected, the form is ambiguous and should be rejected as incomplete/invalid.

8

Validates mechanical limits option is only used with 5-digit odometers

Checks that the “IS IN EXCESS OF ITS MECHANICAL LIMITS” option is only selectable when the 5-digit odometer option is selected, as stated on the form. This prevents incorrect certifications that could misrepresent the vehicle’s mileage history. If the mechanical-limits box is selected with a 6-digit odometer, the system should force correction or route to manual review.

9

Validates date read is a real calendar date in MM/DD/YYYY format

Ensures the odometer “DATE READ” is provided, follows a strict date format (MM/DD/YYYY), and represents a valid calendar date (e.g., not 02/30/2025). The date is important for establishing when the mileage was observed relative to the sale/transfer. If invalid or missing, the submission should be rejected because the disclosure is incomplete.

10

Checks date read is not in the future and is reasonably recent

Validates that the date read is not later than the submission date and optionally enforces a reasonable window (e.g., not older than a configurable number of days) to reduce stale disclosures. This helps ensure the mileage statement reflects the vehicle’s condition at the time of sale/transfer. If the date is in the future or unreasonably old, the system should flag the record and require confirmation or correction.

11

Requires seller identity fields and signature completion

Verifies that the seller’s signature and printed name are present and that the seller address fields (street, city, state, zip) are completed. The seller’s attestation under penalties of perjury is a core legal requirement of the disclosure. If any seller identity or signature element is missing, the form should be treated as unsigned/invalid and not accepted.

12

Requires buyer identity fields and signature completion

Verifies that the buyer’s signature and printed name are present and that the buyer address fields (street, city, state, zip) are completed. The form is an “acknowledgment” as well as a disclosure, so buyer participation is required to document receipt/acceptance of the mileage statement. If buyer information or signature is missing, the submission should be rejected or routed for follow-up.

13

Validates state fields are valid US state/territory abbreviations

Checks that the seller and buyer state entries are valid two-letter USPS abbreviations (e.g., FL) and not free-form text. Standardized state values improve downstream matching, mailing, and jurisdictional processing. If invalid, the system should prompt for correction to prevent address standardization failures.

14

Validates ZIP code format for seller and buyer addresses

Ensures ZIP codes are either 5 digits or ZIP+4 (#####-####) and not alphabetic or incomplete. Correct ZIP codes are important for identity verification, correspondence, and record quality. If ZIP validation fails, the system should block submission or require correction before acceptance.

15

Prevents buyer and seller from being identical without explicit confirmation

Compares buyer and seller printed names (and optionally addresses) to detect cases where the same party is entered as both buyer and seller, which may indicate a data entry error or an unusual transaction type. This check reduces fraud risk and improves data integrity for title transfer workflows. If a match is detected, the system should require an explicit confirmation and/or route the submission to manual review.

Common Mistakes in Completing HSMV 82993

People often complete HSMV 82993 out of habit without checking whether a Florida title issued on or after April 29, 1990 is available or whether another approved reassignment/POA form was used. Using the wrong form can cause the tax collector office to reject the paperwork or require you to redo the transaction documents. Before filling it out, confirm whether the odometer disclosure can/should be made on the title or on another required state/federal form, and only use this form when the instructions say it is appropriate.

VINs are long and easy to misread (e.g., confusing 0 with O, 1 with I, or missing a character), and many people copy it from an ad or insurance card instead of the vehicle or title. An incorrect VIN can invalidate the disclosure, delay title processing, and trigger additional verification requirements. Always copy the VIN directly from the title/vehicle and double-check every character against the source before signing.

Because the odometer section feels like the “main” part, filers sometimes skip the vehicle description fields or only fill in some of them. Missing identifiers can make it harder to match the disclosure to the correct vehicle and may lead to rejection or requests for correction. Fill out every vehicle description field legibly and ensure it matches the title exactly.

The form explicitly states “.XX (NO TENTHS),” but people still write decimals, add “miles,” use commas incorrectly, or include estimated ranges. Incorrect formatting can cause the disclosure to be considered incomplete or inconsistent with legal requirements. Record the odometer as a whole number only (no tenths), and write it clearly in the spaces provided.

Many filers check a box without understanding the legal meaning—especially the difference between “reflects actual mileage” and “not the actual mileage (odometer discrepancy).” Choosing the wrong status can create a branded title/odometer discrepancy, expose the signer to legal risk, or cause the buyer to dispute the sale. Read the caution carefully and select the option that truthfully matches the vehicle’s odometer situation; when unsure, verify the odometer type and history before checking a box.

The form references 5- or 6-digit odometers and notes that “exceeds mechanical limits” applies to 5-digit odometers, which can confuse people with older vehicles. If you check “exceeds mechanical limits” incorrectly (or fail to check it when applicable), the mileage disclosure may be inaccurate and could lead to compliance issues. Confirm whether the odometer rolls over (common on older 5-digit units) and only use the mechanical-limits option when the odometer has exceeded its maximum and rolled over.

People sometimes forget the date entirely or write an ambiguous format (e.g., 1/2/24) that can be interpreted differently. Missing or unclear dates can lead to rejection, delays, or questions about when the mileage was certified. Use the requested format (month/day/year) and ensure the date reflects when the odometer reading was actually taken.

A common error is having only the seller sign, only the buyer sign, or having someone else sign without proper authority. Missing or improper signatures can invalidate the disclosure and force the parties to redo documents, delaying title transfer. Ensure both seller and buyer sign in the correct places, and if a representative is signing, confirm they are legally authorized and that any required supporting documents are included.

Filers often sign but forget to print their name, or they print a nickname that doesn’t match the title/ID. Mismatched or missing printed names can create identity verification issues and slow processing if the office cannot clearly identify the parties. Print full legal names exactly as they appear on the title and identification, and make sure the printed name corresponds to the signature line.

Because address fields appear routine, people frequently omit apartment/unit numbers, ZIP codes, or even the state, or they use a temporary address without clarity. Incomplete addresses can cause problems with record accuracy, notices, and follow-up requests, and may require correction before processing. Enter complete mailing addresses for both buyer and seller, including street, city, state, and ZIP (and unit number if applicable).

Many assume the form must be filed with the state and don’t keep copies, or they forget the instruction that copies should be exchanged and dealers must retain records for five years. Lack of copies can create major issues if there is a later dispute about mileage, title problems, or an audit. Make copies for both parties immediately after completion, and if you are a dealer, store the document in your records for the required retention period.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out HSMV 82993 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills state-of-florida-department-of-highway-safety-and forms, ensuring each field is accurate.