Fill out disclosure forms

with AI.

Disclosure forms are essential legal documents designed to ensure transparency between parties in a transaction or relationship. They require one party to reveal specific facts—such as the condition of a property, the history of a vehicle, or potential financial interests—to protect the interests of the other party. By standardizing the exchange of information, these forms help mitigate legal risks and build trust in high-stakes environments like real estate, finance, and healthcare.

By continuing, you acknowledge Instafill's Privacy Policy and agree to get occasional product update and promotional emails.

About disclosure forms

These forms are typically used by professionals and individuals alike during significant life events. For instance, home sellers and real estate agents often use California realtor forms like Lead-Based Paint disclosures to meet federal safety requirements, while car buyers and sellers use Odometer Disclosure Statements to verify vehicle mileage. Similarly, taxpayers may need to submit disclosure authorization forms to allow representatives to access confidential records. Whether you are navigating a property sale, applying for a loan, or authorizing the release of medical records, these documents provide the necessary legal framework to ensure all parties are fully informed.

Completing these detailed documents manually can be time-consuming and prone to errors. Tools like Instafill.ai use AI to fill these disclosure forms in under 30 seconds, handling the data accurately and securely to streamline the administrative process.

Forms in This Category

- Enterprise-grade security & data encryption

- 99%+ accuracy powered by AI

- 1,000+ forms from all industries

- Complete forms in under 60 seconds

How to Choose the Right Form

Disclosure forms are essential legal tools used to ensure transparency, protect consumer rights, and comply with state or federal regulations. Because these forms vary significantly by industry and location, choosing the right one depends on your specific transaction or regulatory requirement.

Real Estate and Property Disclosures

If you are involved in a property sale or lease, specific disclosures are mandated by law to protect buyers and tenants:

- California Residents: Use C.A.R. Form FLD for any residential property built before 1978 to disclose potential lead-based paint hazards.

- New York Sellers: The Property Condition Disclosure Statement (DOS-1614-f) is required for sellers of one-to-four family residential units to outline the physical state of the property.

Financial and Banking Disclosures

Financial disclosures are typically used to assess creditworthiness or clarify fee structures:

- German Banking: If applying for a loan in Germany, you will need a version of the Selbstauskunft / Vermögensaufstellung (Financial Self-Disclosure). These forms provide banks with a comprehensive view of your assets and liabilities.

- Investment Transitions: Use the Vanguard Brokerage Account Disclosure statement when moving mutual fund accounts to a consolidated brokerage platform.

- Employer Retirement Plans: The ADP Compensation and Fee Disclosure Statement is designed for plan sponsors to maintain transparency regarding service costs.

Tax and Legal Representation

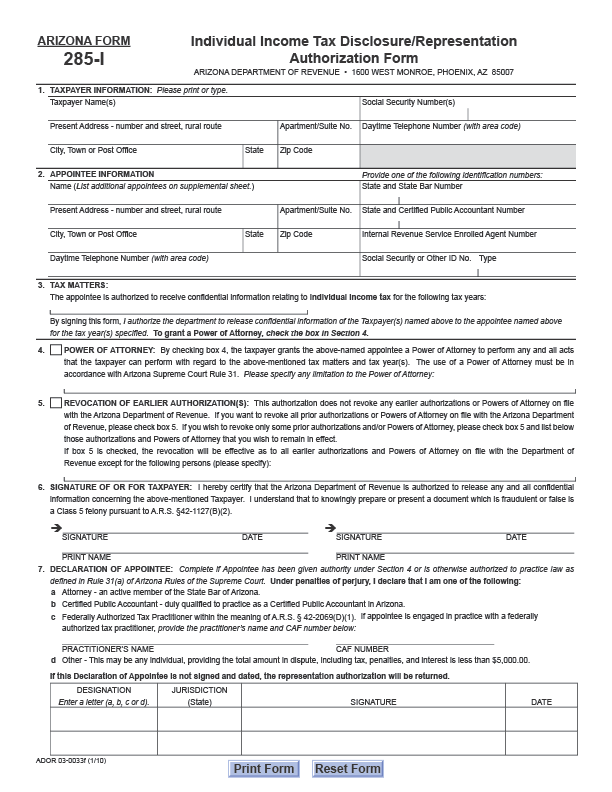

In Arizona, the Department of Revenue requires specific authorization before sharing confidential data:

- Arizona Form 285: Use this for general tax types or when granting broad Power of Attorney for tax representation.

- Arizona Form 285-I: Choose this specifically for individual income tax matters and to name an appointee to receive your private tax information.

Healthcare, Vehicles, and Compliance

- Medical Records: Use the Kaiser Permanente Authorization (Form NS-9934) to legally share health information with third parties. For out-of-network referrals, use the Cigna Out-of-Network Referral Disclosure Form.

- Vehicle Sales: In Florida, if the odometer reading isn't on the title, you must use FLHSMV Form 82993 to certify mileage.

- State Vendors: Use DS 1891 if you are an applicant or vendor seeking to work with California regional centers.

Form Comparison

| Form | Purpose | Sector/Agency | Trigger Event |

|---|---|---|---|

| Arizona Form 285, General Disclosure/Representation Authorization Form | Authorizes representatives to access confidential tax data and handle disputes. | Arizona Department of Revenue | When naming an appointee for business or general tax representation. |

| Arizona Form 285-I, Individual Income Tax Disclosure/Representation Authorization Form | Authorizes representation and disclosure specifically for individual income tax matters. | Arizona Department of Revenue | When individuals need a CPA or attorney to access tax records. |

| State of Florida Department of Highway Safety and Motor Vehicles (FLHSMV) Form HSMV 82993, Separate Odometer Disclosure Statement and Acknowledgment | Certifies vehicle mileage accuracy and odometer reading during ownership transfers. | Florida DMV / Automotive | When selling a vehicle without mileage disclosure on the title. |

| C.A.R. Form FLD, Lead-Based Paint and Lead-Based Paint Hazards Disclosure, Acknowledgment and Addendum (Revised 11/10) | Discloses lead-based paint hazards and provides safety pamphlets to buyers. | California Real Estate | Selling or leasing residential property built before 1978. |

| DS 1891, Applicant/Vendor Disclosure Statement (State of California Department of Developmental Services) | Discloses ownership, control, and potential conflicts for state-funded vendors. | CA Dept. of Developmental Services | Applying for vendorization with a California regional center. |

| New York State Department of State (Division of Licensing Services) Property Condition Disclosure Statement (DOS-1614-f) | Discloses property condition, environmental risks, and structural issues to buyers. | New York Real Estate | Before a buyer signs a contract for residential property. |

Tips for disclosure forms

Disclosure forms are legal certifications; providing false or incomplete information can lead to fines, lawsuits, or the cancellation of contracts. Always double-check facts like vehicle mileage, property history, or financial assets before signing the document.

Most disclosure forms, especially in real estate and vehicle sales, must be presented to the other party before a contract is signed. Delivering these documents early protects you from claims that you withheld material information during the negotiation process.

AI-powered tools like Instafill.ai can complete complex disclosure forms in under 30 seconds with high accuracy. Your data stays secure during the process, making it a reliable time-saver when you have multiple forms to manage.

When disclosing property conditions or tax information, keep the original reports or receipts that back up your statements. These records are invaluable if a buyer or government agency questions the details of your disclosure later.

Forms involving health or tax information, like those for Kaiser Permanente or the Arizona Department of Revenue, require precise recipient details. Ensure you are only authorizing the specific individuals or entities necessary to prevent the accidental release of confidential data.

Disclosure requirements vary significantly by state, such as California's lead-based paint rules or New York's property condition statements. Always verify that you are using the most recent version of the form specific to your state to ensure full legal compliance.

Many disclosure forms are invalid without signatures from all involved parties, such as both the buyer and seller. Review the final page carefully to see if a notary public is required, as failing to do so can significantly delay your transaction.

Frequently Asked Questions

Disclosure forms are legal documents used to provide transparency by revealing specific facts or potential conflicts of interest to another party. They are common in real estate, finance, and healthcare to ensure all participants have the information needed to make informed decisions and to limit legal liability for the disclosing party.

Requirements vary by state, but generally, sellers must disclose known material defects or environmental hazards, such as lead-based paint in older homes or structural issues. In states like New York or California, specific forms are required by law to be delivered to the buyer before a binding contract is signed.

Yes, you can use AI tools like Instafill.ai to fill out disclosure forms in under 30 seconds. The AI accurately extracts data from your source documents and places it into the correct fields, ensuring the form is completed efficiently and with high accuracy.

Federal and state laws require mileage disclosure to prevent odometer fraud and ensure the buyer knows the vehicle's true history. In Florida, for example, Form HSMV 82993 is used to certify whether the reading reflects the actual mileage, helping to protect both the buyer and the seller during the title application process.

You should use forms like Arizona Form 285 or 285-I when you want to authorize a third party, such as a CPA or attorney, to receive your confidential tax information. These forms are essential because the Arizona Department of Revenue cannot discuss your private tax records with anyone else without your written consent.

A 'Selbstauskunft' is a financial self-disclosure form commonly used by German banks to assess a borrower's creditworthiness. It provides a comprehensive view of your assets, liabilities, income, and expenses, allowing the bank to make an informed decision regarding loan applications or credit services.

Filling out complex disclosure forms manually can take a significant amount of time, but using online AI tools significantly speeds up the process. With Instafill.ai, you can complete these documents in under 30 seconds by letting the AI handle the data entry from your existing files.

No, a property disclosure statement is the seller's account of known property conditions and is not a substitute for a professional inspection. Buyers are strongly encouraged to hire an independent inspector to verify the home's condition and review public records before finalizing a purchase.

Yes, healthcare providers like Kaiser Permanente or Cigna require specific authorization forms to comply with HIPAA and other privacy regulations. These forms allow you to grant permission for your medical records to be shared with lawyers, insurance companies, or other third parties for legal or personal matters.

In California, the seller or landlord is responsible for providing the Lead-Based Paint Disclosure (C.A.R. Form FLD) for housing built before 1978. Real estate agents also have a duty to ensure that all parties comply with these federal disclosure requirements to protect against legal risks associated with lead hazards.

Providing incomplete or inaccurate information on forms like the DS 1891 can result in the denial of your application or the termination of your vendor status. Since these forms are often signed under penalty of perjury, it is critical to ensure all ownership, control, and relationship details are reported truthfully.

Glossary

- Power of Attorney (POA)

- A legal designation that grants an individual the authority to act on behalf of another person, often used in tax and financial disclosures to allow representatives to sign documents or access records.

- HIPAA Authorization

- A document that complies with the Health Insurance Portability and Accountability Act, allowing healthcare providers to release a patient's protected health information to a third party.

- Odometer Disclosure Statement

- A legally required declaration made by a vehicle seller certifying the accuracy of the mileage displayed on a vehicle's odometer at the time of sale.

- Lead-Based Paint Addendum

- A federally mandated disclosure for residential properties built before 1978, requiring sellers or landlords to notify buyers and tenants of known lead hazards.

- SIPC (Securities Investor Protection Corporation)

- A non-profit corporation that provides limited insurance coverage to investors if their brokerage firm fails, often mentioned in financial account disclosure statements.

- Cost Basis

- The original purchase price of an investment, such as mutual funds or stocks, which is used to calculate taxable gains or losses when the asset is moved or sold.

- Vendorization

- The official process of being authorized by a state agency, such as a California Regional Center, to provide and receive payment for services to eligible individuals.

- Selbstauskunft

- A standard German financial term for a self-disclosure or statement of assets, typically required by European banks to evaluate a borrower's creditworthiness.