2023 Schedule IL-E/EIC, Illinois Exemption and Earned Income Tax Credit (Illinois Department of Revenue) Completed Form Examples and Samples

Explore a clear, filled-out example of the 2023 Schedule IL-E/EIC, Illinois Exemption and Earned Income Tax Credit. This sample provides a step-by-step visual guide to help you accurately complete your own form, calculate the credit, and list dependents.

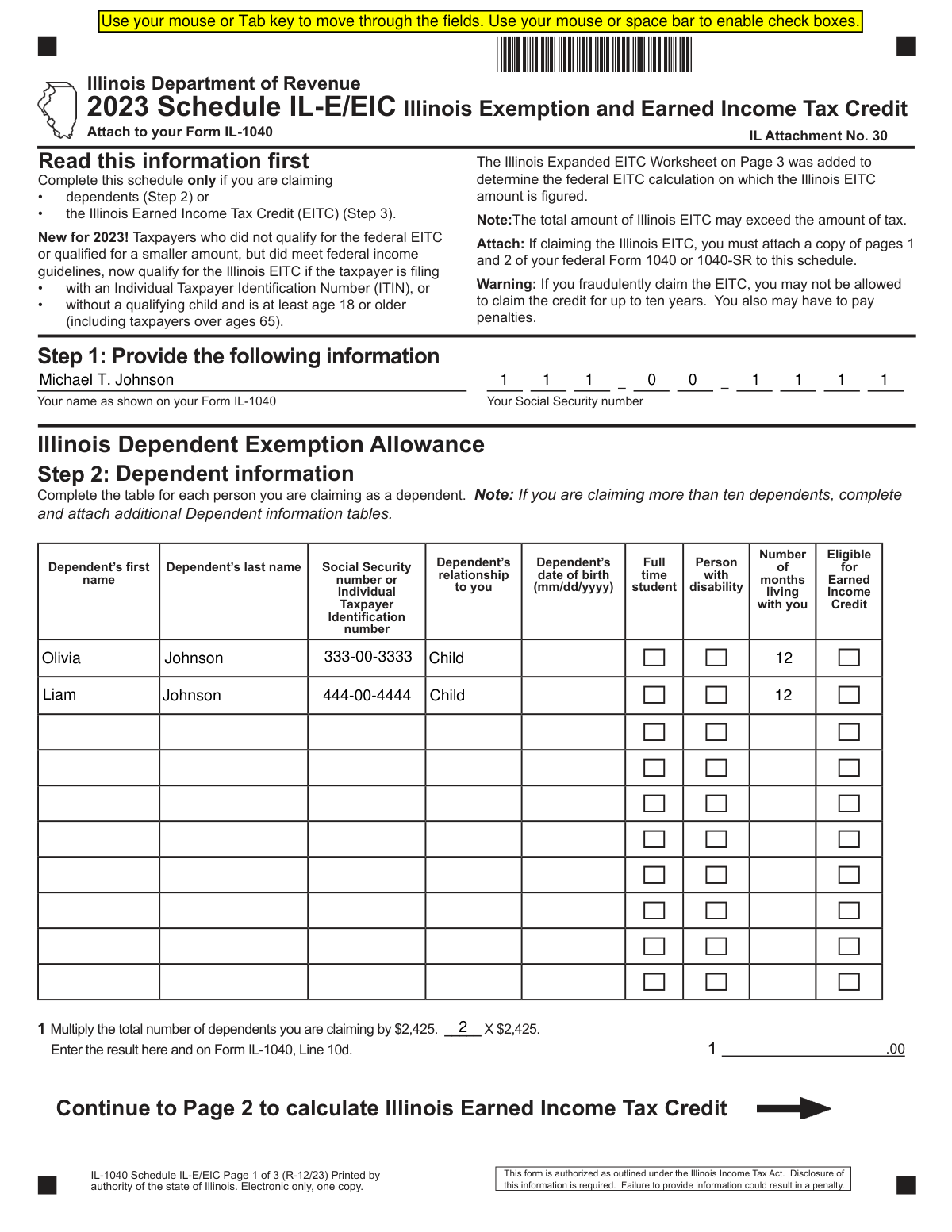

2023 Schedule IL-E/EIC Example – Married Couple with Two Children

How this form was filled:

This example shows how a married couple, Michael and Sarah Johnson, filing jointly with two qualifying children, would complete the 2023 Schedule IL-E/EIC. It details listing their children for the EIC, entering their federal earned income credit amount, and calculating their Illinois credit at 20% of the federal amount.

Information used to fill out the document:

- Primary Taxpayer Name: Michael T. Johnson

- Primary Taxpayer SSN: 111-00-1111

- Spouse Name: Sarah L. Johnson

- Spouse SSN: 222-00-2222

- Address: 456 Oak Avenue, Springfield, IL 62704

- Number of Exemptions (from Form IL-1040, Line 10): 4

- Qualifying Child 1 Name: Olivia R. Johnson

- Qualifying Child 1 SSN: 333-00-3333

- Qualifying Child 1 Birth Year: 2015

- Qualifying Child 1 Months in Home: 12

- Qualifying Child 2 Name: Liam P. Johnson

- Qualifying Child 2 SSN: 444-00-4444

- Qualifying Child 2 Birth Year: 2018

- Qualifying Child 2 Months in Home: 12

- Federal Earned Income Credit (from federal Form 1040, Line 27): $4,500.00

- Illinois EIC Percentage (for tax year 2023): 20%

- Calculated Illinois Earned Income Credit: $900.00

- Signature Date: 04/10/2024

What this filled form sample shows:

- Accurate completion of the taxpayer information section for joint filers.

- Correctly listing qualifying children in Part 2, including names, SSNs, and birth years.

- Properly transferring the federal Earned Income Credit amount to Line 6.

- Demonstrates the calculation of the Illinois Earned Income Credit (Line 7) by multiplying the federal EIC by 20% (0.20).

Form specifications and details:

| Use Case: | Married couple filing jointly with two qualifying children. |

| Form Name: | Schedule IL-E/EIC, Illinois Exemption and Earned Income Tax Credit |

| Issuing Agency: | Illinois Department of Revenue (IDOR) |

| Tax Year: | 2023 |

| Form Number: | IL-1040 Schedule E/EIC |

Created: February 05, 2026 09:49 PM